Apr 20, 2021

All the Reasons Stocks Have Stopped Going Straight Up This Week

, Bloomberg News

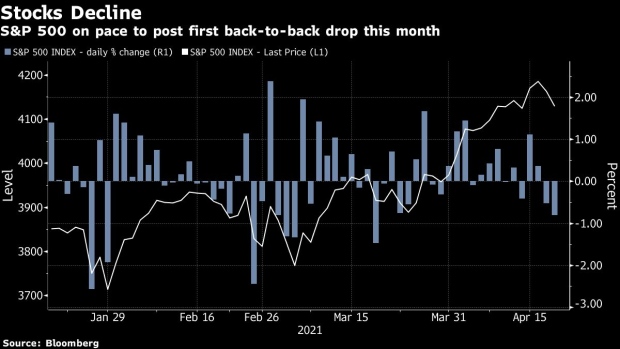

(Bloomberg) -- Up four weeks and six of the last seven, U.S. stocks are doing something they haven’t done since March: fall on consecutive days. For the first time in a long time, Wall Street pundits found themselves trying to explain a weak market.

Covid-19 cases are surging around the world. Anxiety is swirling that new lockdowns could be afoot. Tension is rising between the U.S. and Russia. Already stretched technical indicators are finally giving way.

Those were the theories stuffing inboxes Tuesday afternoon, efforts to explain the 1.1% drop befalling investors in a market priced at the highest forward multiple since 2002. Sometimes markets just fall, but it doesn’t stop people from trying to say why.

“The weaker start to this week is driven a bit by the notion that everybody deserves a rest once in a while, even the market,” said David Donabedian, chief investment officer of CIBC Private Wealth Management. “We’ve had a magnificent run and markets need time to breathe a little bit -- even in a bull market, you can temporarily run out of buyers for a while.”

Of all the signals in the market on Monday and Tuesday, the most tangibly worrisome were selloffs in stocks that had run up most over the the past month on the prospects of a broader economic reopening and the return of inflation. Travel companies bore the brunt of selling. Booking Holdings Inc. and Norwegian Cruise Line Holdings Ltd. each lost more than 4.5% on Tuesday, while the JETS airline exchange-traded fund sank 4.1%.

But to Chris Grisanti, chief equity strategist at MAI Capital Management, it’s too early to call an end to the reflation trade. “If you look three months out, the U.S. is in a good place. The variants are not going to stop the world from reopening,” he said. “I would use this to buy those reopening stocks you missed the first time.”

The S&P 500 declined as much as 1.1%, its biggest drop in more than a month. The tech-heavy Nasdaq 100, typically seen as a defensive area of the market, dropped 1.3%. The Russell 2000 fell 2.7% for its worst session in three weeks. The wipeout places the small-cap index’s year-to-date gains in-line with those of the S&P 500.

Here’s what market-watchers had to say about this week’s declines:

David Sowerby, portfolio manager at Ancora Advisors:

“Let’s call it one part fundamental and two parts technical. Fundamental would be that you’ve had such high expectations on earnings estimates going higher and higher. Expectations on profits and revenue were getting extraordinarily robust and P/E ratios as one valuation measure were already stretched. From a fundamental perspective, it begins to explain days like yesterday combined with days like today,” he said. “In tandem with that was technicals -- the market had four straight weeks of going higher. It’s natural, given the run, that the market would take a little pause and small caps would be the victim. We’d been drinking the stronger earnings Kool-Aid, but at some point you hit some saturation level.”

Fiona Cincotta, senior financial markets analyst at City Index:

“We had the all-time high last week and then this week it feels like the tone in the market is starting to change a bit. We have some concerns surrounding rising Covid cases. Although the U.S. is reopening and the U.K., there are still a lot of concerns that there are countries still in the thick of the Covid crisis. The concern is how that is going to impact the global economic recovery.”

Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors:

“With earnings season now underway, companies are facing the pressure to justify their recent gains and in many cases lofty valuations. Investors are especially anxious to hear how companies view a future that could include both rising costs and higher taxes,” he said. “It is fair to say that the reflation trade is taking a well-earned breather, but it is far too early to suggest this rotation has run its course. Sectors that are more levered to the economy are likely to reassume leadership in the months ahead as we transition from recovery to expansion.”

Rick Bensignor, president of Bensignor Investment Strategies:

“The market was very stretched -- we honed in on a level of S&P 4,130 to 4,140. It’s a tight level in which we thought we could see a peak from and we passed it last week. I said that things are good as long as we don’t give back last week’s rally this week. It’s still early in the week but as of right now, we have given it back,” he said. “We’re below it but the week’s not over. We’re exhaustive and the fact that we overshot it last week is only significant if we continue to hold up this week -- and the fact that we’re not makes me somewhat concerned. If we’re anywhere near the 4,130-4,140 level come Friday, I’d say that we still have a good chance of pulling back from here and that the exhaustion that we’re seeing is still at hand.”

Willie Delwiche, an investment strategist at All Star Charts:

“Given the degree of the move we’ve had, some sort of consolidation, some sort of choppiness would not be unexpected. And we’re transitioning into the second year of the rally and there, not only do you tend to have less robust market gains, but you also tend to have more volatility. So some of that is just a natural aging process,” he said by phone. “We’ve had a tremendous rally and if you look at valuation indicators, you’d say, OK, it’s priced in this recovery that we’re looking for. So I think that’s probably in investor’s minds a little bit, that stocks aren’t cheap here. So if the reason that you were buying stocks earlier this year was because even though they were expensive, they were going up -- but if they stopped going up, then what you’re left with is stocks that are expensive.”

©2021 Bloomberg L.P.