Mar 26, 2024

Altice France’s Investor Call Spurs Week of Frenzied Bond Trades

, Bloomberg News

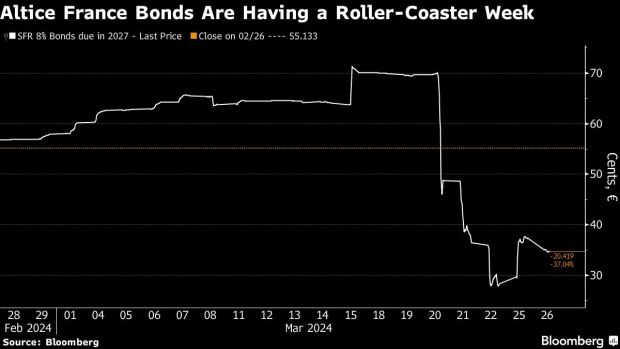

(Bloomberg) -- A dramatic week for Altice France SA sparked intense trading in its bonds, with at least $2 billion of debt linked to the firm changing hands.

The trading desk at Goldman Sachs Group Inc alone has handled over $1 billion of debt issued from the Altice suite of companies, according to one run seen by Bloomberg. At 8:19 a.m. New York time on Monday hourly trading volume was more than 10 times the average, TRACE Market Flow data compiled by Bloomberg showed.

The flurry of buying and selling followed a call with creditors on Wednesday, in which the management team told investors they would have to participate in “discounted transactions” to help the company slash its debt. The bonds sank on the news, with some falling to below 30 cents on the euro. But trading hasn’t all been one way. On Monday the notes recouped some of their losses, with Altice France making up seven of the top 10 performing securities in a European high-yield index.

Read more: Drahi’s Altice Says Creditors Must Take Cuts to Reach Targets

Among the other transactions, Royal Bank of Canada has traded around $500 million of Altice France debt since Thursday, while Barclays exchanged at least $120 million of debt across the Altice company network on Monday, according to another run seen by Bloomberg. Meanwhile, JPMorgan Chase & Co traded at least $175 million the day following the investor call and $100 million on Monday, a separate run showed.

Spokespeople for Altice, Barclays, Goldman Sachs, JPMorgan declined to comment. Representatives of RBC didn’t respond to requests for comment.

Debt Stack

Altice is a rarity for its size, with around €24 billion ($26 billion) of debt at the Altice France level. The total jumps to nearly $60 billion when including the liabilities of Altice International and Altice USA, according to the latest full-year reports from the companies.

Many high-yield investors are looking to decrease or exit their holdings as Altice France prepares to tackle its debt pile, while opportunistic buyers are eyeing a potential entry point.

The company is working with Lazard Inc, while a group of secured creditors holding both bonds and loans has selected Gibson Dunn & Crutcher as legal counsel, as previously reported by Bloomberg.

A separate group of bondholders has been talking to Houlihan Lokey Inc, Milbank LLP and Wilkie Farr & Gallagher.

©2024 Bloomberg L.P.