Sep 6, 2022

Aluminum Stocks Jump as Traders Eye Shift From Shortage to Glut

, Bloomberg News

(Bloomberg) -- A jump in London Metal Exchange aluminum inventories is adding to mounting evidence of weakening demand for one of the world’s most important industrial metals, while some key buyers are trying to shun Russian supplies.

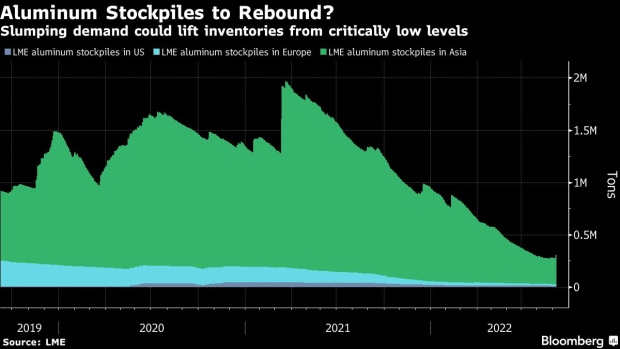

Warehouse stockpiles tracked by the LME surged by 11% on Tuesday, the biggest increase since February, and rebounding from a three-decade low struck in August. Like several other metals, aluminum has been caught for months in a push-pull between tight physical supplies and worries about a deteriorating economic outlook.

There are growing signs that consumption is suffering, which could lead to even bigger inflows onto the LME -- typically the market of last resort. Some buyers are already asking to roll forward purchase volumes under contract for this year into 2023, according to two senior aluminum traders, asking not to be identified discussing private information.

A shift to oversupply would represent a reversal for the global aluminum market, which has faced acute shortages as a construction boom boosted demand while Europe’s energy crisis hobbled production. The challenges for producers look set to get worse over winter, but the surge in power and gas prices is threatening to create an even greater slump in factory output, hurting demand.

“In Germany, so far we’ve seen more supply losses than demand destruction, but things are looking trickier going forward,” Bank of America Corp. strategist Michael Widmer said by phone. Futures prices on the LME have already reacted to the growing demand risk, with aluminum trading more than 40% below a peak in March.

There’s also a growing question mark over the role of Russian metal in the global market following the invasion of Ukraine, particularly as negotiations get underway this month for annual supply contracts across the industry. Aluminum hasn’t been targeted with sanctions by the US or Europe, but some major buyers including Novelis Inc. are seeking to avoid Russian metal in new deals.

Russian aluminum giant United Co. Rusal International PJSC saw a rise in metal inventories and raw materials over the first half of the year as production outpaced sales. The risk for the market is that large amounts of unwanted Russian metal begin to flow into LME warehouses, creating distortions, said two senior aluminum traders. Rusal declined to comment.

Aluminum prices on the LME declined 1.1% to settle at $2,260.50 a ton on Tuesday. Aluminum inventories rose by 31,325 tons to 308,375 tons.

At one level, rising inventories should be welcomed by the LME, after a sharp decline in stockpiles on the bourse sparked a series of historic price spikes, culminating in a hugely controversial short squeeze in the nickel market in March.

But any large influx of Russian aluminum could create new problems for the bourse, if aluminum futures quoted on the LME end up trading at steep discounts to prevailing prices in the physical market.

The LME doesn’t currently plan to take independent action outside the scope of sanctions, and doesn’t see any evidence of LME warehouses being used to offload metal on a long-term basis, a spokeswoman for the exchange said in an emailed statement.

The LME’s priority is to maintain an orderly market and it will keep the situation under review, she said.

(Updates aluminum price; adds details on stockpiles and LME comment in final four paragraphs)

©2022 Bloomberg L.P.