Nov 22, 2021

AMC Insiders Have Unloaded $70 Million of Stock This Year

, Bloomberg News

(Bloomberg) -- AMC Entertainment Holdings Inc. has surged almost 20-fold this year after thousands of retail investors piled in to defend the stock against short sellers looking to profit from its decline. “You buy. You hold,” read a recent tweet with dozens of likes.

Top management has taken a different tack.

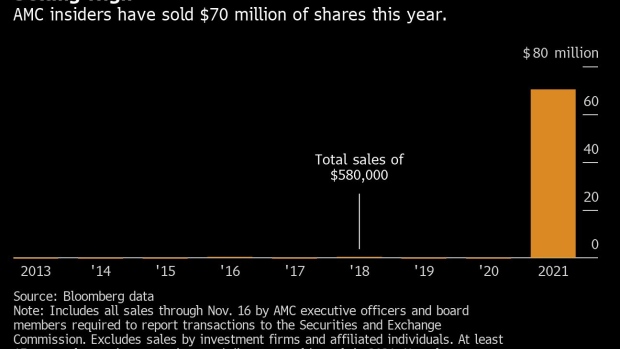

Executives and board members at the movie theater chain have unloaded shares worth more than $70 million in 2021 after selling a fraction of that amount in prior years, according to regulatory filings. Chief Executive Officer Adam Aron became the biggest seller of that group this month when he sold stock worth more than $25 million, saying it was prudent for estate-planning purposes. None have made purchases.

Many of the stock sales, including Aron’s, were pre-planned. A spokesman for Leawood, Kansas-based AMC, declined to comment.

AMC was struggling financially for years even before the pandemic pummeled the theater business in 2020, causing a sharp drop-off in revenue from which the industry still hasn’t recovered. But in January, fired-up retail traders rushed in, driving up the share price and helping rescue AMC from the brink of bankruptcy.

The stock has retreated from an early June peak, but is still up more than 1,800% this year, even with revenue unlikely to recover to even half the $5.5 billion the company collected in 2019.

Corporate executives frequently sell stock they get as compensation, especially recently with the ascending market. But Aron has publicly courted retail investors and touted AMC’s future prospects while selling stock and benefiting from the rally.

Drawing less attention have been sales by other AMC executives and board members. As many as 14 of them have sold stock this year, including General Counsel Kevin Connor and Chief Marketing Officer Stephen Colanero.

Connor has sold more than $4 million of shares in 2021, mostly this month, after not having sold any in the previous eight years, according to data compiled by Bloomberg. Colanero has unloaded $5.6 million, also mostly this month, compared with about $200,000 over three prior years.

Sean Goodman, who became chief financial officer in 2020, has sold all of the shares he owns -- more than $8.5 million worth -- though he stands to collect additional stock in the future from restricted and performance-based awards.

Executives and directors are free to do as they wish with shares of companies where they work or serve on boards, provided no restrictions are attached. And AMC’s insiders stand to collect hundreds of thousands more shares if they remain there long enough or if the company hits performance targets.

While insiders at numerous companies have taken advantage of this year’s stock market rally to lock in gains, shareholder advocates say it’s not a promising sign when they unload large quantities.

“If they don’t think it’s a good place for their capital, then shareholders should be concerned about whether it’s a good place for their capital,” said Nell Minow, vice chair of ValueEdge Advisors, which works with institutional shareholders on corporate-governance issues.

In October 2020 -- when AMC was trading around $3 a share -- the company suspended minimum stock ownership guidelines that normally apply to its executives because of its “currently depressed stock price and the ongoing impacts of the COVID-19 pandemic.” The guidelines stipulated that AMC’s CEO hold three times his or her annual salary in stock, while other executives had to own two times their salaries.

It’s rare for companies to suspend stock ownership guidelines, said Jun Frank, executive director of ISS Corporate Solutions, a Rockville, Maryland-based consultant that advises companies on corporate governance and executive pay.

“Typically this should only be a short-term solution,” Frank said.

Aron said Nov. 8 that the board approved his recommendation for a new executive stock ownership policy at its most recent meeting. That policy generally requires him as CEO to retain the equivalent of eight years’ salary in fully owned or board-granted AMC stock. Other senior executives’ stock ownership is also addressed.

A frequent Twitter user who has embraced AMC’s new meme-stock status, Aron has defended his stock sales. He pointed out that he still owns millions of units of stock in the company, which are mostly in the form of equity grants, as well as performance-based awards.

“I can only imagine that naysayers and others who wish AMC harm will try to spread fear, uncertainty and doubt,” about his then-planned stock sales, Aron said on the November earnings call. “I fervently believe in AMC, and my interests are very much aligned with our broad shareholder base.’

©2021 Bloomberg L.P.