Jul 16, 2019

Analyst ‘Trading Idea’ Calls Have a Surprisingly Strong Record

, Bloomberg News

(Bloomberg) -- If you’re a fund manager, this happens fairly often. You get an email or phone call from an analyst pushing an idea that isn’t one of his formal buy or sell recommendations, but a tactical move that might net a few percentage points over the next days or weeks.

New research suggests they are worth heeding.

In a study called “Are Analyst Trade Ideas Valuable?," academics found that rather than being evidence Wall Street research shops have run out of things to sell, such tips have an enviable record of profitability. They often move prices, possibly because institutional investors assume they will and jump in.

“Analysts’ trading calls have a significant market impact, consistent with analysts being prominent information intermediaries,” wrote Justin Birru and René Stulz of Ohio State, Sinan Gokkaya of Ohio University, and Xi Liu of Miami University. “Our results indicate that investors following trading buys and sells can generate significant characteristic and risk-adjusted returns.”

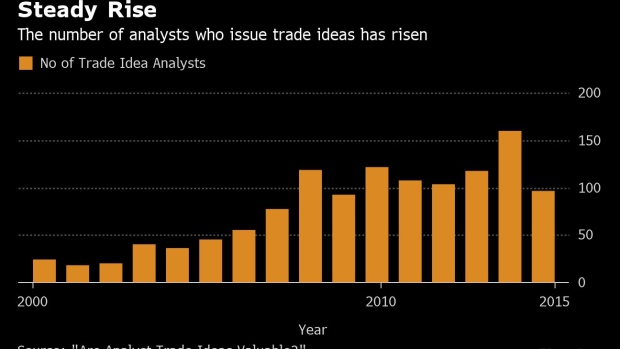

While multiple studies have tried to value analysts’ standard bill of fare -- stock recommendations, profit forecasts and price targets -- virtually none has examined the usefulness of the short-term trading idea that securities firms are coughing up with increasing frequency. Such calls are proliferating -- the total increased by almost sixfold between 2000 and 2015 -- with about 14% of analysts making them, the research found.

What are they? Usually advice keyed to an upcoming event, a buyback announcement, say, or a share sale, that has decent odds of moving prices in the short term. They tend to come from bigger brokerages and carry higher stakes than ordinary buy/sell recommendations -- both for their audience and the firms making them.

“With a trade call, the investment horizon is short, and the call is based on a specific trading opportunity. While a successful trading call could make an analyst’s name, an unsuccessful one may damage her reputation,” the authors wrote. ”These calls are more likely to be issued by more experienced analysts.”

The authors found that the stock-level impact from the dissemination of trade ideas is just as large as the one seen when analysts change their company recommendations. The size of the price effect is more than three times larger than those seen in the wake of earnings forecast or price target revisions.

Buy recommendations in trading calls see benchmark-adjusted returns of 0.9% on the day they’re announced and the day after, on average. If it’s a sell, the magnitude is even larger, with the stock falling near 2% over the same time period on a benchmark-adjusted basis.

The biggest difference between trade ideas and other analyst offerings comes down to their expiration date. About 98% of trade ideas expire within one week to three months. On the other hand, price targets and recommendations usually have a shelf-life of more than a year. For the purpose of the study, a sample of 4,543 trade ideas from sell-side analysts across more than 1,600 firms was created.

Institutions have taken note. In data from 130 million transactions across more than 800 money managers, the authors found that trading activity -- measured from the likes of volume and turnover -- usually peaks on the days when analysts issue their advice.

“The results reinforce the interpretation that trade calls convey distinct, incremental fundamental information to the financial markets, and primary consumers of such research trade on this,” the authors wrote. “Trade research contains value-relevant information for financial market participants.”

‘You Have to Be Skeptical’

Out in the field, Max Gokhman says his inbox is flooded with hundreds of sell-side emails every day. The head of asset allocation for Pacific Life Fund Advisors views virtually everything he gets from Wall Street as “color” and says most investors wouldn’t admit to acting on them even if they were.

“You’re supposed to be making your own decisions,” Gokhman said. “You have to be skeptical with everything, where someone may have an incentive that’s not just to provide you with good information. It’s not like you would ever say that to a sell-side analyst, but there is always that kind of understanding.”

With reason. Brokerage analysts produce the most trade recommendations for stocks that have the highest commissions, according to the study.

“Brokers seem to selectively choose to issue trade calls on stocks with higher commission generation potential,” the authors wrote. “Collectively, the evidence is consistent with brokers selectively focusing trading calls on stocks for which they receive the greatest monetary benefits.”

To contact the reporter on this story: Sarah Ponczek in New York at sponczek2@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

©2019 Bloomberg L.P.