Mar 21, 2023

Angola Central Bank Cuts Key Rate Back-to-Back for First Time

, Bloomberg News

(Bloomberg) -- Angola’s central bank cut borrowing costs at back-to-back meetings for the first time since the benchmark rate was adopted in 2018 as it forecasts inflation to continue to slow.

The monetary policy committee reduced the rate to 17% from 18%, Governor Jose de Lima Massano told reporters Tuesday in Luanda, the capital.

In January, the Banco Nacional de Angola lowered the key rate by 150 basis points — its most aggressive cut since July 2018.

The decision was taken “with the aim of continuing to influence price stability in the economy and ensuring a course of inflation in line with medium-term objectives,” Massano said. “With the improvement in price conditions, it doesn’t make sense to maintain a conservative interest rate,” he said.

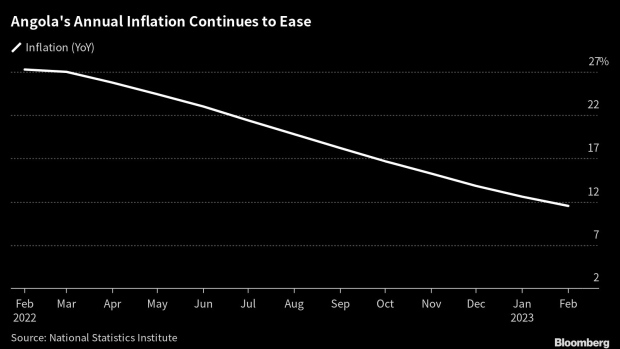

Annual inflation in Africa’s third-biggest oil producer eased for 13 consecutive month in February to 11.5%, its lowest level in almost eight years. The MPC forecasts inflation will end the year at 9% to 11%.

That’s in contrast to other African nations such as Nigeria and Morocco where inflation is still running hot. Both increased their key rates Tuesday.

The Angolan kwanza is the second best performing currency in Africa against the dollar this year of those tracked by Bloomberg. It has remained relatively stable even as investors have become a lot more selective in which developing markets they invest in, especially since the collapse of Silicon Valley Bank and the troubles at Credit Suisse Group AG. The relative stability is likely to keep inflation in check.

Angolan banks are not exposed to Credit Suisse, Deputy Governor Pedro Castro e Silva said at the same press conference. “We have been following what happened with Credit Suisse. It does not pose a concern to the Angolan financial system,” he said.

The latest rate cut may help bolster much-needed economic growth in a nation where the majority are mired in poverty. The Finance Ministry forecasts the economy to expand 3.3% in 2023.

Angola’s MPC next meets May 19.

(Adds with a comment from central bank vice governor in penultimate paragraph)

©2023 Bloomberg L.P.