Mar 27, 2024

Arm Wager on Options Expiring in 2026 Yields $300 Million Profit

, Bloomberg News

(Bloomberg) -- A trader or group of traders netted some $300 million over the past two days by closing out bullish options positions in Arm Holdings PLC.

The contracts were opened in batches throughout January and early February, when the stock fluctuated between roughly $67 and $80. The target was call options expiring in January of 2026 with strike prices of $67.50, $70, and $72.50. The trades ultimately drove open interest across the three contracts to around 60,000 as of Monday.

Euphoria for chipmakers and Arm’s strong earnings beat have sent the shares soaring 78% since the beginning of February. That jump put the slate of 2026 call options in the money, with the underlying trading for close to $125 at midday. Yet the stockpile sat for over a month.

Read Arm Traders Quietly Stockpiling Call Options Have Yet to Cash In

On Tuesday and Wednesday, the option investor or investors decided to cash in — nearly two years before the options expire. Contracts bought for between $20 and $25 earlier this quarter were sold for closer to $70 and $80. All told, the trader netted some $300 million in profit, according to Bloomberg calculations.

Why now? It’s impossible to know. There could be any number of reasons for selling this week, from trimming exposure to locking in winnings before the quarter ends, said Christopher Jacobson of Susquehanna International Group.

“Perhaps it’s as simple as taking profits on a position that appeared to be established for longer-term upside but quickly turned profitable as the stock rallied sharply since the time of initiation,” he said.

Even after the Tuesday trade, a slew of Arm in-the-money call options expiring in January 2026 remain. Meaning, someone is hoping for even more profits from this bet.

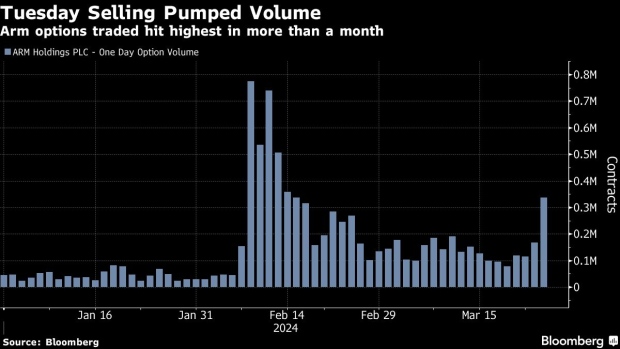

Tuesday’s trading brought total option volume to 337,000, more than double the average over the past month.

©2024 Bloomberg L.P.