Apr 2, 2023

Asia’s Factories Encounter Hurdles in Further North-South Split

, Bloomberg News

(Bloomberg) -- China’s manufacturing activity unexpectedly eased in March, a private survey showed, leading a slide in factory gauges across Asia as the global economic outlook darkened.

China’s Caixin manufacturing purchasing managers index — which covers mainly smaller and export-oriented businesses — eased slightly last month as new orders and output both declined, registering a 50 reading that’s exactly the line between expansion and contraction.

The PMIs for factories across Asia showed a continued divergence between North and South in March. Japan, South Korea, and Taiwan all stayed in contraction territory while much of Southeast Asia’s factory outlooks remained in expansion, although at a slightly slower or little changed pace from the previous month, according to S&P Global on Monday.

India’s PMI was an outlier showing more resilience, with the March reading jumping further in expansion territory to 56.4 from 55.3.

Asia’s export powerhouses are seeing subdued demand amid a global economic outlook beset by elevated inflation and borrowing costs and rising risks of recession. North Asian economies also are dealing with geopolitical risk and volatility in the semiconductor industry. An oil-price pop on OPEC+’s decision to slash supply by a million barrels has added to challenges in the global economic outlook.

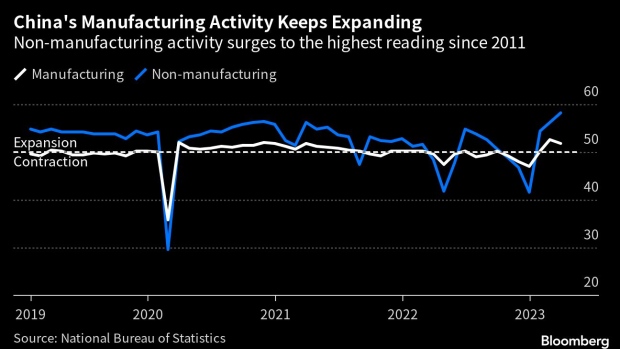

In China, latest indicators show the post-reopening recovery is being led mainly by the non-manufacturing sectors, particularly consumer spending on services and a pickup in construction.

The Caixin PMI index — which was lower than February’s 51.6 and the 51.4 median in a Bloomberg survey of economists — was also weaker than the official PMI for manufacturing, released on Friday. That index showed an expansion in manufacturing activity in March, although at a slightly slower pace than the previous month. The non-manufacturing index surged to the highest in more than a decade, the official data showed last week.

What Bloomberg Economics Says...

March’s bigger-than-expected drop in the Caixin manufacturing PMI reinforces our view that China’s recovery after the exit from Covid Zero remains patchy. The main drivers of growth — services spending and government investment — don’t appear to be boosting the smaller businesses and exporters tracked in the Caixin survey.

For the full report, click here.

David Qu, China economist

The PMI reading indicated there were signs of a weakening in China’s rebound, Wang Zhe, a senior economist at Caixin Insight Group, said in the statement accompanying the release.

“The foundation for economic recovery is not yet solid,” he said. “Only by working hard to stabilize employment, increase household income, and improve market expectations, can the government reach its goal of restoring and expanding consumption.”

China’s exports have plunged in recent months, casting a shadow over the economy’s recovery. Even so, economists predict the rebound in consumer spending and a pickup in government investment will be enough to push full-year growth above 5% this year. Housing sales are also expanding again. China’s state media reported Monday the economy will see rapid growth in the second quarter.

Japan’s PMI was at 49.2 in March from 47.7 in the previous month. South Korea slipped to 47.6 from 48.5, the worst since September. Taiwan’s factory gauge stayed in contraction territory — below 50 — in March, sliding to 48.6 from 49 the previous month, data showed Friday.

There was a brighter outlook in Indonesia, Southeast Asia’s biggest economy, where the PMI ticked up to 51.9 from 51.2, the best showing since September. Thailand and the Philippines eased slightly while staying in expansion. Vietnam fell to 47.7 from 51.2 while Malaysia posted a contraction at 48.8.

For Southeast Asia, “optimism across the region remained strongly upbeat, and with inflationary and supply chain pressures subsiding, this bodes well for the recovery of the sector,” said Maryam Baluch, an economist at S&P Global Market Intelligence.

--With assistance from Cecilia Yap.

(Updates with India figures in fourth paragraph and chart.)

©2023 Bloomberg L.P.