Apr 13, 2023

U.S. stocks gain as data anchor bets peak rates is near

, Bloomberg News

BNN Bloomberg's closing bell update: Apr. 13, 2023

U.S. equities traded higher Thursday, as the latest readings on jobs and factory-gate inflation were slightly softer than expected, a boost for those hoping the Federal Reserve may be approaching the end point of an era of aggressive interest rate hikes.

The S&P 500 rose 1.3 per cent while the more rate-sensitive Nasdaq 100 gained 2.0 per cent after U.S. jobless claims for the week ended April 8 rose to 239,000, compared to estimates of 235,000. Meanwhile, producer prices came in at 2.7 per cent year-on-year, versus the 3 per cent that had been expected.

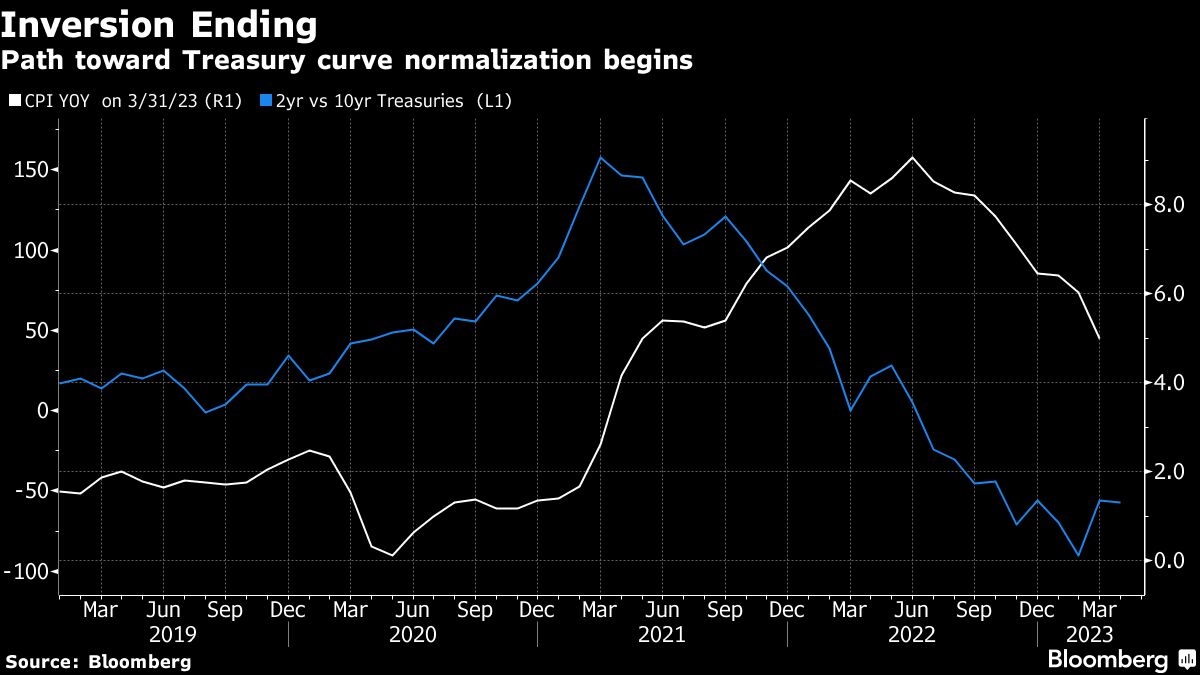

Treasury yields rose with the 10-year trading around 3.44 per cent. The dollar lost more ground against a basket of currencies, and the euro/dollar exchange rate was at a one-year high.

“Basically what the data are showing is two things,” Que Nguyen, chief investment officer of equity strategies at Research Affiliates, said by phone. “The first is that inflation is not surprising to the upside, and at the same time, the job market seems stable. And so what we’re getting today is sort of an optimistic outlook that we’re going to have an almost like a goldilocks situation where inflation’s going to slow, but the economy is not crashing.”

This week’s consumer inflation report showed a fall in year-on-year headline figures, but a rise in core prices. Meanwhile, last week’s March payrolls rose at a firm pace with unemployment near record lows again. All that has left swaps markets still favoring a quarter-point hike by the Federal Reserve in May, though traders added to wagers that the Fed will cut interest rates by year-end at a faster pace than anticipated earlier in the week.

“For a Fed already inclined to pause, this report tips the scale just a bit more in favor, especially after yesterday’s CPI failed to reveal any new inflationary problems,” Christopher Low of FHN Financial said. “The link between the PPI and CPI is not as clear as it once was, but persistently small increases — or, as in March, an outright decline — will eventually come through to consumers.”

Minutes of the Fed’s March meeting published Wednesday showed policymakers scaled back expectations for rate hikes this year after a series of bank collapses roiled markets, and stressed they would remain vigilant in the face of a potential credit crunch. Officials also forecast a “mild recession” starting later this year given “the potential economic effects of the recent banking-sector developments.”

Next, investors will be turning their attention to bank earnings starting on Friday and commentary from executives on the probability of a recession.

“Bank lending is arguably the most important component of a strong economy, so insights from bank CEOs are critical right now,” David Trainer, CEO of New Constructs, wrote. “Investors are counting on strong earnings to help the year-to-date stock market rally continue, which is why this upcoming first quarter earnings season is so important.”

Europe’s equity benchmark posted a modest gain. Oil fell, gold rose, and Bitcoin traded around US$30,300.

Key events this week:

- U.S. retail sales, business inventories, industrial production, University of Michigan consumer sentiment, Friday

- Major U.S. banks JPMorgan Chase, Wells Fargo and Citigroup report earnings, Friday

Some of the main market moves:

Stocks

- The S&P 500 rose 1.3 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 2 per cent

- The Dow Jones Industrial Average rose 1.1 per cent

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.6 per cent

- The euro rose 0.5 per cent to US$1.1047

- The British pound rose 0.3 per cent to US$1.2527

- The Japanese yen rose 0.3 per cent to 132.74 per dollar

Cryptocurrencies

- Bitcoin rose 1.3 per cent to US$30,354.47

- Ether rose 5.4 per cent to US$2,012.48

Bonds

- The yield on 10-year Treasuries advanced six basis points to 3.45 per cent

- Germany’s 10-year yield was little changed at 2.37 per cent

- Britain’s 10-year yield was little changed at 3.57 per cent

Commodities

- West Texas Intermediate crude fell 1.2 per cent to US$82.29 a barrel

- Gold futures rose 1.5 per cent to US$2,054.70 an ounce