Oct 24, 2023

Nasdaq 100 climbs 1% as earnings season picks up

, Bloomberg News

BNN Bloomberg's mid-morning market update: Oct. 24, 2023

Stocks rose after their longest slide this year, with bond-market volatility abating and traders wading through a raft of earnings for clues on the outlook for Corporate America. Oil slid below US$84 a barrel.

The S&P 500 halted a five-day drop while the Nasdaq 100 gained 1 per cent. Bullish forecasts from Verizon Communications Inc., 3M Co. and General Electric Co. lifted the shares. Meta Platforms Inc. fell after being sued by California and a group of states over harmful youth marketing claims. Treasury 10-year yields edged lower, following Monday’s intense volatility. Bitcoin briefly topped $35,000.

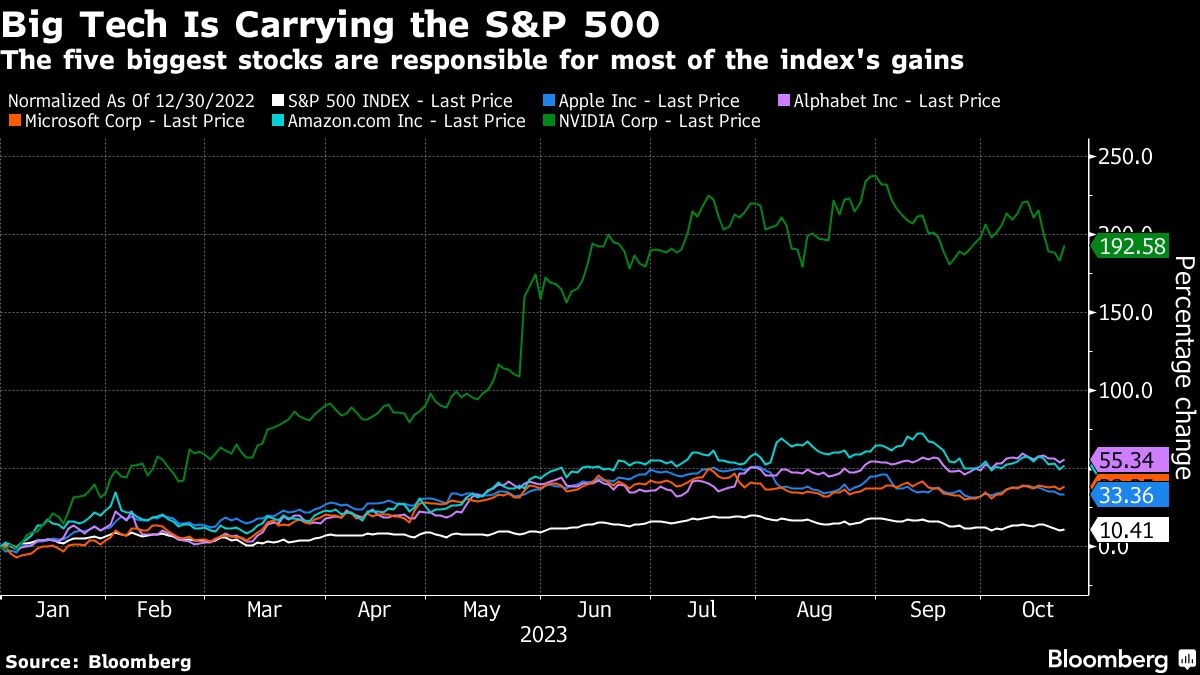

Investors looking to the earnings season for a dose of good news are hanging their hopes on big tech. The five biggest companies in the S&P 500 — Apple Inc., Microsoft, Alphabet, Amazon.com Inc. and Nvidia Corp. — account for about a quarter of the benchmark’s market capitalization. Their earnings are projected to jump 34 per cent from a year earlier on average, according to analyst estimates compiled by Bloomberg Intelligence.

“As these big tech stocks go, so does the overall market,” said David Trainer, chief executive officer of New Constructs. “If big tech companies blow their numbers out of the water and provide strong guidance for future earnings, then we could see the stock market rally strongly through the end of the year.”

Rising rates have made already stretched big tech valuations look increasingly expensive, with the group remaining the most-crowded trade among fund managers, according to Bank of America Corp.

That’s prompted investors to pay up for protection against a selloff in Alphabet and Microsoft — two of the handful of heavyweights responsible for all of the S&P 500’s advance this year. Investors are banking on them to deliver earnings growth big enough to push the stocks higher — or at least enough to justify this year’s gains.

The pain in long-duration growth stocks, fueled in recent weeks by a relentless surge in Treasury yields, is finally on the verge of subsiding. That is, at least, if the so-called Taylor Rule is anything to go by.

The equation, posited by Stanford economist John Taylor in 1993, has become a way to measure how the Federal Reserve can use its overnight bank lending rate to tame inflation or stimulate the economy. Now, it’s approaching a critical inflection point for the U.S. equity market by signaling that the central bank has finally normalized rates.

U.S. business activity picked up in October after back-to-back months of stagnation, helped by a rebound in factory demand and an easing in service-sector inflation

“The U.S. economy is generating growth, but it still must digest the ‘last mile’ of policy tightening in our view,” said Don Rissmiller of Strategas. “We would be more convinced that the growth we are seeing was high-quality or sustainable growth if the labor market was re-balanced (with labor demand equal to supply). Until then, the risk remains that continued restrictive monetary policy becomes too restrictive.”

Elsewhere, Chinese President Xi Jinping stepped up support for the economy, issuing additional sovereign debt, raising the budget deficit ratio and even making an unprecedented visit to the central bank. Bank of Japan officials are likely to monitor bond yield movements until the last minute before making a decision on whether to adjust the yield curve control program at a policy meeting next week, according to people familiar with the matter.

Corporate Highlights

- Apple Inc. will redesign its TV app in a step toward consolidating the company’s various video offerings later this year, according to people with knowledge of the matter, part of its efforts to become a bigger player in the streaming world.

- Qualcomm Inc., stepping up its long-running effort to break into the personal computer market, unveiled a new laptop processor designed to outperform rival products from Intel Corp. and Apple Inc.

- General Motors Co. can no longer say if it will make up to $14 billion in profit this year because a United Auto Workers strike, now in its sixth week, has made the company’s financial future too difficult to predict.

- Barclays Plc lost as much as $2.7 billion in market value on Tuesday after inaugurating the reporting season for UK banks by lowering its forecast for lending profitability.

- Spotify Technology SA rallied after the music-streaming giant reported third-quarter results that beat expectations on sales and subscriber growth, all during a time when it raised prices.

- Kimberly-Clark Corp., the maker of Scott bath tissue, raised its earnings outlook for the year as shoppers proved willing to keep paying more for essential goods.

- RTX Corp.’s profit topped Wall Street expectations and the company announced a $10 billion share-buyback program as it works to contain fallout from a costly quality lapse in its marquee engine for commercial aircraft.

Key events this week:

- Australia CPI, Wednesday

- Germany IFO business climate, Wednesday

- Canada rate decision, Wednesday

- U.S. new home sales, Wednesday

- IBM, Meta earnings, Wednesday

- European Central Bank interest rate decision; President Christine Lagarde holds news conference, Thursday

- U.S. wholesale inventories, GDP, U.S. durable goods, initial jobless claims, pending home sales, Thursday

- Intel, Amazon earnings, Thursday

- China industrial profits, Friday

- Japan Tokyo CPI, Friday

- U.S. PCE deflator, personal spending and income, University of Michigan consumer sentiment, Friday

- Exxon Mobil earnings, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.7 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 1 per cent

- The Dow Jones Industrial Average rose 0.6 per cent

- The MSCI World index rose 0.5 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.3 per cent

- The euro fell 0.7 per cent to $1.0592

- The British pound fell 0.7 per cent to $1.2163

- The Japanese yen fell 0.1 per cent to 149.88 per dollar

Cryptocurrencies

- Bitcoin rose 7.1 per cent to $33,787.3

- Ether rose 3.9 per cent to $1,776.25

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.82 per cent

- Germany’s 10-year yield declined five basis points to 2.83 per cent

- Britain’s 10-year yield declined six basis points to 4.54 per cent

Commodities

- West Texas Intermediate crude fell 2.2 per cent to $83.62 a barrel

- Gold futures fell 0.2 per cent to $1,984.10 an ounce