Jun 8, 2022

Australia’s Biggest Bank Sees RBA Cutting Interest Rates in 2023

, Bloomberg News

(Bloomberg) -- Australia’s largest lender expects current aggressive monetary policy tightening to weigh heavily on the economy and force the Reserve Bank to reverse course and cut interest rates in the second half of 2023.

Commonwealth Bank of Australia on Thursday downgraded its GDP growth forecasts and now predicts the A$2.2 trillion ($1.6 trillion) economy will expand 3.5% this year, down from a previous 4.7%, and then slow to a “below‑trend” 2.1% in 2023, compared with 3.1% seen previously.

The RBA “looks very intent on dropping the inflation rate quickly,” said Gareth Aird, head of Australian Economics at CBA. “But this will come at the expense of growth in aggregate demand, particularly household consumption.”

Australia’s central bank surprised markets and economists this week with a 50 basis point rate rise to 0.85% and signaled its intention to rapidly normalize policy. Governor Philip Lowe said the RBA’s board will do “what is necessary” to ensure that inflation returns to its 2-3% target band.

A number of economists are pricing in a further half-point increase in July or August and Aird expects the cash rate will reach 2.1% by year’s end, with a risk of 2.35%.

“With the RBA now expected to take the cash rate to a contractionary setting we have penciled in rate cuts for the second half of 2023,” he said in a research note, forecasting 50-basis points of rate cuts in that period.

He also expects:

- Headline inflation to peak at 6.25% over 2022 and then decline to within the 2‑3% target by late 2023

- Unemployment to stay at a very low 3.75% over 2022, then move higher over 2023 to 4.5%

- National home prices to decline by about 15% by end-2023 -- from peak to trough

Aird added that fiscal policy “remains incredibly important” to the outlook and is “a key source of uncertainty.”

Australia ended nine years of center-right rule at a May 21 ballot, electing the Labor party to office. New Treasurer Jim Chalmers is planning to hand down a budget in the second half of October.

Aird isn’t the only economist predicting the RBA will have to ease back from aggressive tightening.

What Bloomberg Economics Says...

“Were the RBA to tighten as much as markets project, it would trigger a recession -- forcing it to reverse course and cut rates as soon as 2H 2023. We doubt it will go that far”

James McIntyre, Economist.

For full report, click here

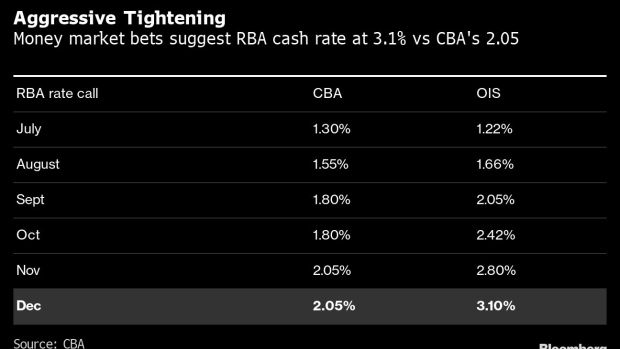

Money markets are pricing in outsized hikes from the RBA in coming months and see the cash rate above 3% by December.

“Our central bank appears to now be first and foremost inflation fighters,” Aird said. “Their objective of ‘the economic prosperity and welfare of the people of Australia’ has taken a back seat to their desire to drop the rate of inflation.”

©2022 Bloomberg L.P.