Nov 8, 2022

Bank of England Chief Economist Suggests Pandemic QE a Mistake

, Bloomberg News

(Bloomberg) -- Bank of England Chief Economist Huw Pill suggested that officials made a mistake in continuing their stimulus program through the pandemic, saying the money-printing has contributed to rocketing inflation.

Answering questions from lawmakers in the House of Lords, Pill said the decisions taken might have been different “with the benefit of hindsight.” Inflation is 10.1%, five times the BOE’s target rate.

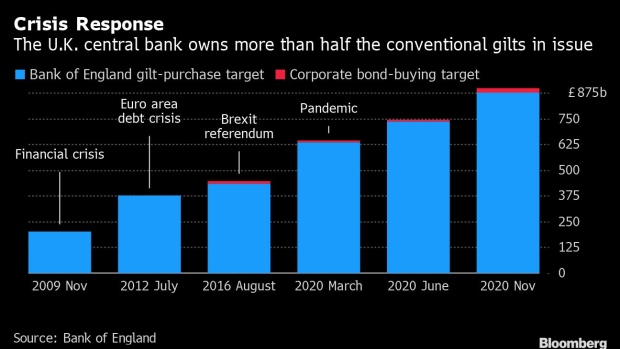

Pill’s implied criticism of his colleagues’ decisions before he joined the BOE is the first time a rate-setter has admitted the central bank may have contributed to the cost-of-living crisis. Critics have argued that the massive increase in the money supply largely caused by the BOE’s £450 billion of quantitative easing has fueled inflation.

Pill insisted that the main reason for the overshoot was a surge in natural gas costs. But he acknowledged another factor was “other developments in the past -- I think it’s fair to say including choices over monetary policy.”

He stressed he was not at the bank in 2020 when the decisions were taken and added that whether policy makers would have made those choices knowing what they do now “is an open question.”

“The destruction of demand was over-emphasized relative to the destruction of supply, and that probably meant support for demand was stronger than it should have been,” Pill said.

Pill was responding to Mervyn King, a former BOE governor and current member of the House of Lords economic affairs committee. King has accused the bank of overstimulating the economy with QE and contributing to inflation.

The central bank now is racing to reverse that stimulus, both raising interest rates at the strongest pace in 33 years and taking unprecedented steps to unwind some of the bond purchases it made under QE. The BOE has lifted its benchmark lending rate eight times in the past year to 3%, the most in 14 years.

Pill repeated that “there is more to come” on rates.

He said one of the main reason that higher rates are needed is ongoing signs of tightness in the labor market.

Unemployment is at a four decade low, and 600,000 people have dropped out of the workforce since the start of the pandemic. That has caused huge recruitment problems for employers and is driving up wage growth.

Pill said there was a risk that inflation gets embedded in wages, causing more persistent inflation.

Read more:

- BOE’s Pill Says UK Workforce Dropouts Point to More Rate Hikes

- BOE’s Pill Says Market Turmoil De-Anchored Inflation Outlook

- BOE’s Bond Sale Crystallizes £250 Million Loss for UK Government

- BOE Chief Economist Says Rates Will Have To Go Higher Than 3%

©2022 Bloomberg L.P.