Aug 30, 2022

Best Buy's profit tops estimates that were cut by sliding demand

, Bloomberg News

The death of the consumer has been much exaggerated: Portfolio strategist David Dietze

Best Buy Co. surpassed Wall Street’s profit estimate after warning a month ago that it was under pressure from waning consumer-electronics demand.

Adjusted earnings fell to US$1.54 a share in the fiscal second quarter, Best Buy said in a statement Tuesday. That exceeded the US$1.35 average of analyst estimates compiled by Bloomberg, which had come down sharply since the company cut its forecast for the year in late July.

Best Buy is contending with flagging sales of discretionary goods as soaring US inflation forces shoppers to pay more for groceries and other essentials. Consumers are also shifting more spending to travel and other services after binging on televisions, computers and appliances during the first two years of the pandemic.

“We are clearly operating in an uneven sales environment,” Chief Executive Officer Corie Barry said. “We are focused on balancing our near-term response to difficult conditions and managing well what is in our control, while also delivering on our strategic initiatives and what will be important for our long-term growth.”

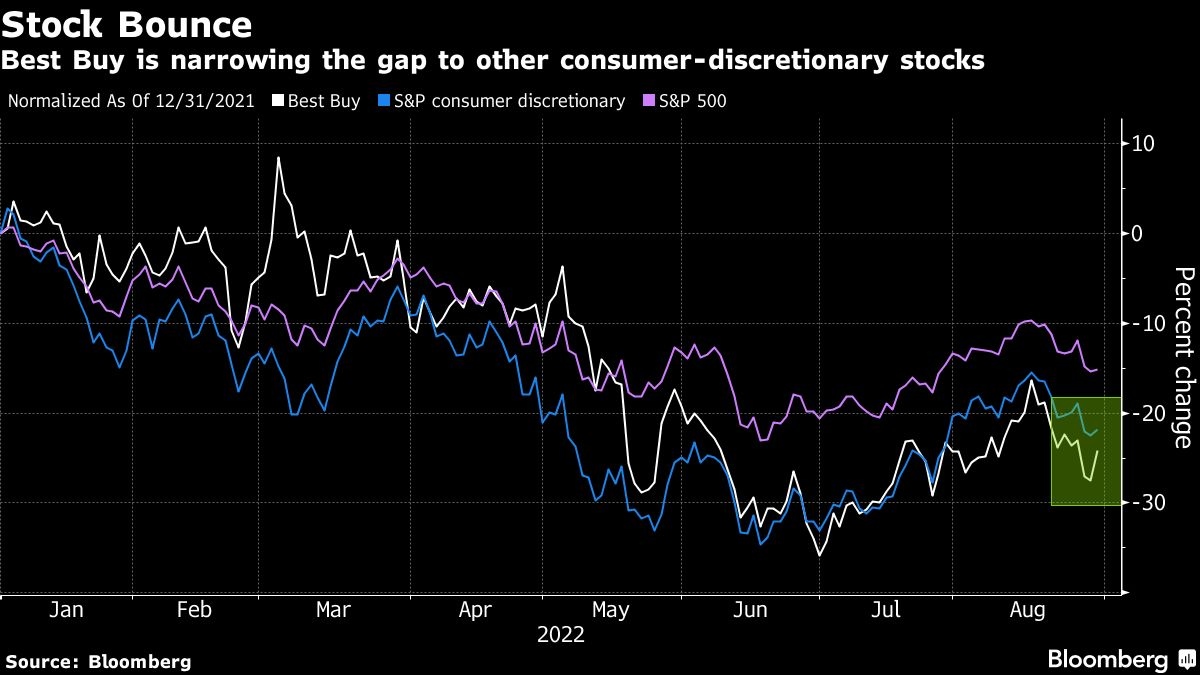

The shares rose 5.2 per cent in New York trading at 9:39 a.m. Best Buy had fallen 27 per cent this year through Monday, while an S&P index of consumer-discretionary companies had lost 23 per cent.

Best Buy said it incurred US$34 million in restructuring costs in the second quarter, mostly in the form of benefits stemming from job cuts, and said it would take on additional expenses during the rest of the year. The Wall Street Journal reported earlier this month that the company is cutting hundreds of jobs in stores.

In the second quarter, which ended in late July, sales tumbled 13 per cent to US$10.3 billion, matching analyst estimates. Enterprise comparable sales fell 12.1 per cent, compared with an average analyst projection of a 13.1 per cent decline.

Adjusted operating income amounted to 4.1 per cent of revenue in the quarter. The company had forecast “a range around 3.7 per cent” last month.

Best Buy reiterated its recently lowered profit and sales forecast for the year while noting that comparable sales will be down “slightly more” in the third quarter than they were in the second quarter. The decline in adjusted operating income rate this quarter “will be very similar to, or slightly more than” what the company saw in the second quarter.

“Best Buy’s steady outlook suggests demand isn’t worsening,” Bloomberg Intelligence analyst Lindsay Dutch said in a report. That’s “a positive signal ahead of the key holiday selling season.”

The company withdrew its forecast for fiscal 2025, which was unveiled less than six months ago.

“The current macro backdrop has changed in ways that we and many others were not expecting,” Barry said on a conference call with analysts. Best Buy will provide more detail on its longer-term expectations “once we begin to experience a more stable operating environment,” she said.