Apr 1, 2023

Best Quarter Since 2019 Makes Euro-Area Bonds Shine Again

, Bloomberg News

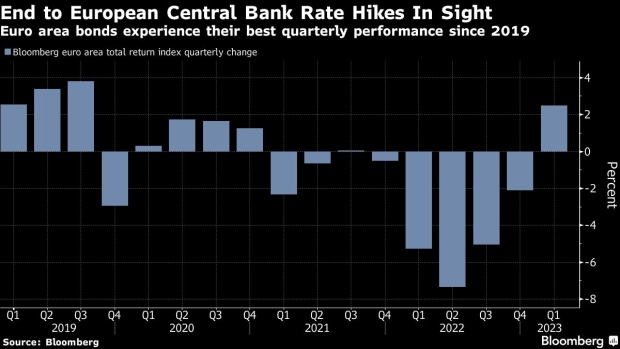

(Bloomberg) -- Euro-area government bonds posted their strongest quarter in almost four years, as market turmoil renewed appetite for an asset class that had long been shunned by investors.

The Bloomberg Euro-Aggregate Treasury Index, which tracks total returns from investment-grade government bonds in the region, was set for a 2.1% gain in the quarter, snapping a record-run of five straight quarterly declines. That would be the best return since 2019 — when the European Central Bank last lowered interest rates.

That’s a strong result for a quarter that was rocked by the most volatile month in history as investors recalibrate their interest-rate hike bets amid an unexpected global banking crisis. While that also boosted US Treasuries in the first three months of the year, returns on the other side of the Atlantic had already been positive in the previous quarter.

“What was negative last year in terms of inflation and rate hikes is starting to shift the other way,” said Georgios Leontaris, chief investment officer at HSBC Private Bank Suisse SA. He’s been buying five- to seven-year German government bonds along with corporate credit, and plans to continue purchasing in the coming months.

Markets are pushing back against ECB official warnings over persistent inflation, focusing on the prospect of potential monetary easing in the wake of last month’s banking turmoil. The upheaval spurred the view that central banks will switch focus to financial stability from inflation.

Traders see the ECB raising the deposit rate by at least a further half-point to 3.5%, compared to a peak of almost 4.2% less than a month ago, according to swap contracts tied to policy-meeting dates. A first quarter-point rate cut is priced by May next year, but some are betting the main rate could return to 0% by then.

Owning government bonds becomes more appealing when faced with the end of a rate-hike cycle, given this would in theory reduce upward pressure on yields and boost the debt’s value.

Charles Diebel, head of fixed income at Mediolanum International Funds Ltd in Dublin, has been favoring safer euro-area debt for the past two months.

“We have been cautious on the macro outlook and looking for growth to slow down with the possibility even of a recession,” he said. “We did well as a result.”

Swings in German two-year bonds — among the most sensitive to changes in monetary policy — were so violent in March that less than one week after rallying the most on record, they registered their biggest slump since the global financial crisis.

Often seen as an early precursor to rate cuts, the gap between five- and 30-year yields on German debt widened last month by the most since 2015. The relatively stronger demand for shorter-dated debt suggests investors expect looser financial conditions.

“Less upward pressure on yields and attractive valuations should be some of the key catalysts to remain invested,” HSBC’s Leontaris said.

©2023 Bloomberg L.P.