Jan 13, 2023

Bets Grow on BOJ Shift That Could Rattle Global Markets

, Bloomberg News

(Bloomberg) -- Traders are gearing up for the Bank of Japan’s first policy review of the year, with bets rising that Governor Haruhiko Kuroda may enact another shift as early as next week.

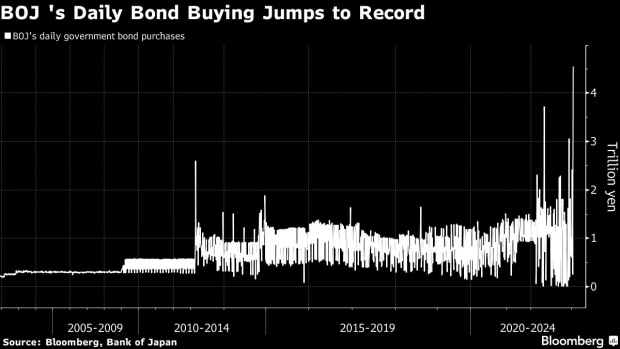

Market participants wagering on another tweak pushed the benchmark 10-year yield past the central bank’s 0.5% ceiling on Friday, prompting authorities to splash out a record amount on debt purchases. Speculation of a change intensified after Yomiuri newspaper said the BOJ will consider adjustments to counter turbulence caused by last month’s revision.

Bets are growing that the BOJ will exit its ultra-dovish settings as inflation accelerates, in a move that’s likely to unleash a bout of volatility on global currency and bond markets. Citigroup Inc. now expects the central bank to terminate its yield curve control next week, and hedge funds have been shorting sovereign bonds.

“Unfortunately, the BOJ has little to show for all their efforts and there seems little reason for the market to back off either,” said Prashant Newnaha, senior Asia-Pacific rates strategist at TD Securities in Singapore. “Rip the band-aid now or throw more money at the problem and delay the exit. An exit is coming, it’s just a question of when.”

All this risks creating more uncertainty for global bond markets, which are trying to come to grips with an evolving Federal Reserve policy outlook. A softer US inflation print is fueling bets for a smaller Fed rate hike in February, and some traders see the US central bank pivoting to an easing later this year.

The BOJ spent a record amount on bond-buying operations for a second day on Friday after the benchmark bond yield climbed as high as 0.54%. Purchases included ¥1.8 trillion ($14 billion) of one-to-25 year debt at market yields and ¥3.21 trillion of 10-year notes and futures-linked securities at a fixed yield of 0.5%.

The BOJ said it’ll conduct additional outright purchases of Japanese government bonds on Monday, with the amounts to be determined by market conditions.

While Governor Kuroda, whose term ends in April, has said the recent change to the ceiling was just to make the curve control program more sustainable, investors suspect that changes are afoot.

Mark Dowding, BlueBay Asset Management’s chief investment officer, earlier said he expects the BOJ to push its upper band for 10-year yields to 0.75% by end-March, while others including UBS Asset Management and Schroders Plc are adding to or sticking with short positions on the bonds.

Judging by the continued rise in yields and yield-curve distortions, “I cannot help thinking the BOJ may actually be trying to lead yield-curve control to an end,” Naomi Muguruma, chief fixed-income strategist at Mitsubishi UFJ Morgan Stanley Securities Co., wrote in a note. “Once it becomes clear that the yield curve is out of control, there’ll be no option left for the BOJ policy board but to end the yield-curve control.”

While a survey of 43 economists showed all but one predict the central bank will leave policy unchanged next week, some 38% of respondents now forecast moves either in April, when a new governor takes the helm, or in June. That’s a jump from 15% in last month’s poll.

“Many investors expect that there will be further moves next week,” said Kamakshya Trivedi, co-head of global FX and interest rate strategy at Goldman Sachs in an interview with Bloomberg Television on Friday, adding that the lack of “big spillovers” to other global rates markets could give the BOJ comfort if it did want to adjust policy settings.

Japan’s key inflation gauge is climbing at the fastest pace in four decades, putting further pressure on the central bank. The BOJ has argued that price pressures will ease next year, giving it room to continue with its ultra-loose monetary policy.

--With assistance from Libby Cherry and Aline Oyamada.

(Adds Goldman Sachs’ strategist comment in 12th paragraph.)

©2023 Bloomberg L.P.