Jun 9, 2023

Beyond Meat Is Set Up for Short Squeeze After Stock Surges 20%

, Bloomberg News

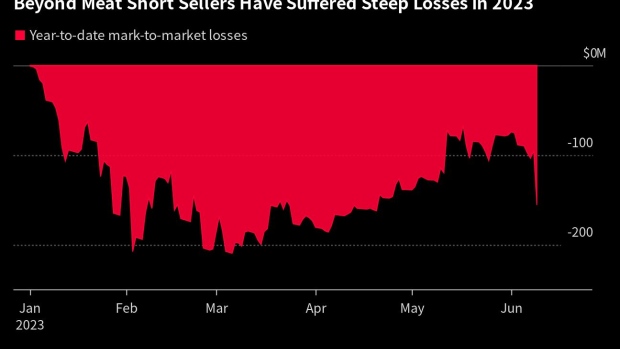

(Bloomberg) -- Beyond Meat Inc.’s 20% jump Thursday stung traders betting against the fake-meat company and set them up for a short squeeze that could lead to even steeper losses.

Beyond Meat short sellers had paper losses of $60 million on Thursday, bringing total mark-to-market losses for the year to $156 million, according to data from S3 Partners LLC. The stock was up about 4.6% in 2023 after Thursday’s gain but retreated Friday.

Adding to the losses is the fees short sellers have to pay betting against the food maker as available shares dwindle. In the last 30 days, 7.5 million Beyond Meat shares were sold short, pushing total short interest to $366 million, or 49% of float, according to S3.

Currently, there are only about 200,000 shares left for short sellers to borrow and bet against, and fees to use that stock could jump to more than 100% of the stock price from the 75% to 95% rate that shorts are currently paying.

“There cannot be a huge rush of short selling in the stock and new stock borrows will be very expensive,” Ihor Dusaniwsky, managing director of predictive analytics at S3, said in an email.

That combination of mounting losses and rising borrowing costs put traders betting against Beyond Meat in a dangerous position. If the stock price holds at current levels or has another run higher, short positions could become too expensive to hold and prompt a squeeze.

A short squeeze is a phenomenon that occurs when traders rush to close out their contrarian bets by scooping of shares of the stock they’ve bet against. This drives the share price higher, leading to even more rapid buying by other short sellers looking to cut their losses.

Read more: Matt Levine’s Money Stuff: Don’t Squeeze the Shorts

Beyond Meat earned the highest short squeeze score of 100 on Thursday, according to S3. While that doesn’t mean a squeeze will happen, it indicates that conditions are set up for one

“It will be very difficult for short sellers to stay in a name that is bleeding red in their P\L reports,” said Dusaniwsky.

©2023 Bloomberg L.P.