Mar 12, 2019

Bitcoin momentum indicator suggests rally risks winding down

, Bloomberg News

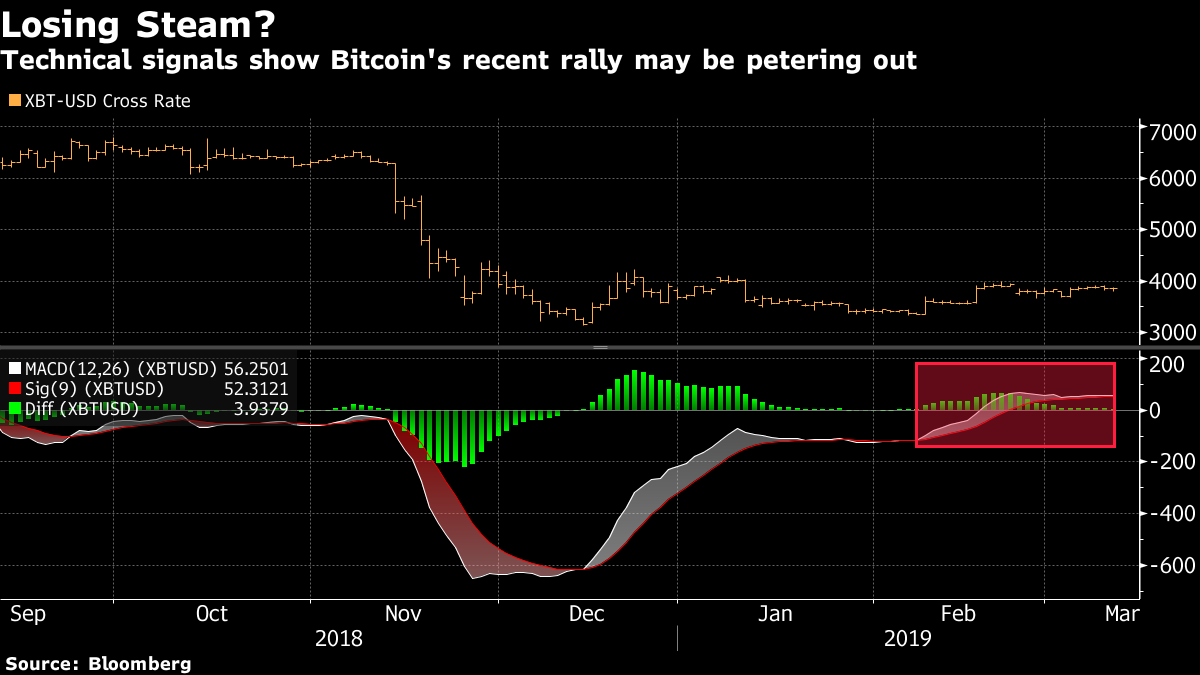

Bitcoin’s recent rally appears to be losing momentum.

Technical gauges signaling long-term buying demand for Bitcoin are deteriorating, potentially showing that selling pressures could intensify. After logging its first positive returns in seven months during February and rising off its 52-week lows, Bitcoin’s Moving Average Convergence Divergence indicator has been steadily falling since mid-February.

The size of Bitcoin’s average daily gain has also dropped from February through the start of March, potentially indicating that the rally could be running into a wall. Last month, the digital currency posted its first monthly gain since July and average daily prices moves turned positive for the first two months of the year. But Bitcoin’s hitting a resistance level of US$4,000, and until that level is breached, its price may continue to come under pressure.

That sentiment rings true to Bloomberg Intelligence analyst Mike McGlone. “The entire industry is ripe to resume a path to lower prices,” he wrote in a recent report. “Conditions are akin to November, just prior to the collapse. Prices are consolidating within narrowing ranges, with a few sharp bear-market rallies that appear fleeting.”

Bitcoin’s gain of 20 per cent in the past three months “isn’t a poor performance. It’s just that investors are seeing more potential in some of the smaller tokens at the moment,” said Mati Greenspan, senior market analyst at eToro, in an email. “As we approach the culmination of the crypto winter, we’re actually seeing some of the altcoins delivering spectacular gains in the last few weeks. We are now in what industry insiders like to call alt-season.”

Ether, the second-largest digital currency after Bitcoin, has gained more than 60 per cent since mid-December. Litecoin has delivered triple-digit returns in the same time frame, rising nearly 150 percent. Bitcoin, on the other hand, is up nearly 23 per cent.