Feb 12, 2024

Bitcoin Surges to $50,000 for the First Time Since 2021 on ETF Demand

, Bloomberg News

(Bloomberg) -- Bitcoin hovered around $50,000 after scaling the closely watched level for the first time in over two years, a remarkable comeback from the crypto scandals and wipeouts that had cast doubt on the industry’s viability.

The largest digital asset was trading at around $49,800 as of 11:22 a.m. Tuesday in London, having earlier risen as high as $50,379. The token has tripled in value since the start of last year following a 64% plunge in 2022. Bitcoin remains roughly $19,000 below the all-time high it touched in November 2021.

The wild price fluctuations seen since the introduction of Bitcoin more than a decade ago have long been one of the main attractions to speculators. While originally promoted as an alternative to the traditional financial system, the latest rally has been driven by optimism that last month’s US approval of spot Bitcoin exchange-traded funds is leading to greater mainstream acceptance.

Read more: What Are These New Bitcoin ETFs and How Do They Work?

“There is a lot of talk about inflow of money into this asset,” said Matt Maley, chief market strategist at Miller Tabak & Co. “I’d also note that the momentum players are getting excited as well.”

Risk Appetite

The resurgence in crypto prices comes as expectations of looser monetary policy burnish the allure of riskier assets. “The appetite for risk has trickled over into digital assets as well,” said Chris Newhouse, a DeFi analyst at Cumberland Labs.

Shares of crypto-related companies also gained Monday with Bitcoin proxy MicroStrategy Inc. rising 11%, trading platform Coinbase Global Inc. increasing 3.8% and miner Marathon Digital Holdings Inc. jumping 14.2%.

The positive sentiment spread to Asian stocks related to digital assets, including advances in companies such as Japan’s Monex Group and Woori Technology Investment Co. in South Korea.

Recovering Losses

Bitcoin has recovered all its losses since the May 2022 implosion of stablecoin TerraUSD, which set in motion a wave of failures that ultimately helped bring down Sam Bankman-Fried’s FTX exchange in November 2022.

By the time FTX went down, the crypto market was already months into a rout that also claimed hedge fund Three Arrows Capital and lender Celsius Network. But the fall of FTX, once one of the top crypto exchanges by trading volume, was even more damaging, with token prices stagnating as liquidity dried up.

Now with Bankman-Fried convicted of fraud, and the Binance exchange’s co-founder Changpeng Zhao awaiting sentencing for US sanctions violations and failing to implement anti-money laundering policies, crypto prices have moved higher as analysts see fewer looming risks to the industry.

ETF Inflows

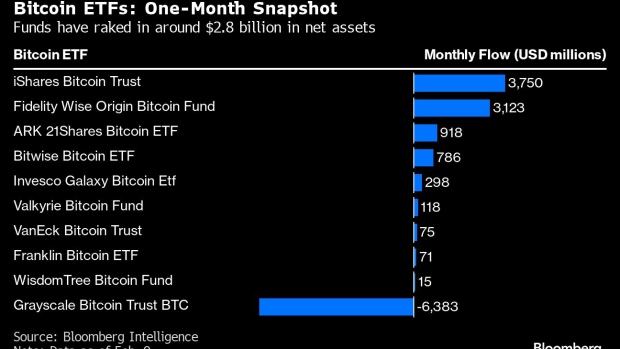

Nine US spot Bitcoin exchange-traded funds debuted on Jan. 11, while the more than decade-old Grayscale Bitcoin Trust converted into an ETF the same day. The accessibility of ETFs promises to widen the investor base for the token. The new funds have attracted in excess of $9 billion so far, while a more than $6 billion outflow from the Grayscale fund since its conversion appears to be losing steam.

“We are a little ways away from there being broader acceptance,” Susan Thompson, head of SPDR Americas Distribution at State Street Global Advisors, said on Bloomberg Television. “Most advisers we talk with are taking a wait-and-see approach.”

Financial advisers need to examine an asset’s correlations over time to assess potential diversification benefits, whereas Bitcoin’s impact is hard to predict as the token is relatively short-lived, Thompson said.

Bitcoin Halving

Optimism about the quadrennial Bitcoin halving due in April is also filtering across crypto. Halving cuts the quantity of Bitcoin that miners receive for operating the powerful computers that verify transactions on the blockchain. The event is often viewed a support for prices based on historical precedent.

Aside from ETF inflows, sentiment toward Bitcoin is “typically positive” during the Lunar New Year holidays that are currently underway in Asia, Fundstrat Global Advisors wrote in a note.

Coinglass data show that about $135 million worth of crypto trading positions betting on lower prices were liquidated on Monday — the highest tally since Jan. 10, the day the US spot ETFs won regulatory approval.

--With assistance from Isabelle Lee, Sunil Jagtiani, Suvashree Ghosh and Sidhartha Shukla.

(Updates prices.)

©2024 Bloomberg L.P.