Mar 6, 2024

BlackRock’s Bitcoin ETF Draws Record Influx as Coin Tops $69,000

, Bloomberg News

(Bloomberg) -- Investors dumped a record amount of cash into BlackRock’s Bitcoin ETF while the cryptocurrency surged to an all-time high.

The iShares Bitcoin ETF (ticker IBIT) pulled $788.3 million Tuesday, its 37th consecutive inflow. The fund has now swelled to $11.5 billion in assets.

Bitcoin briefly topped $69,000 on Tuesday, surpassing the all-time high it hit in late 2021. Demand from the ETFs and a optimism surrounding an upcoming reduction in the token’s supply growth have fueled recent gains, though the coin is now trading near $67,000, likely following profit-taking.

“It’s FOMO, it’s sentiment, it’s momentum,” said Emily Roland, co-chief investment strategist at John Hancock Investment Management.

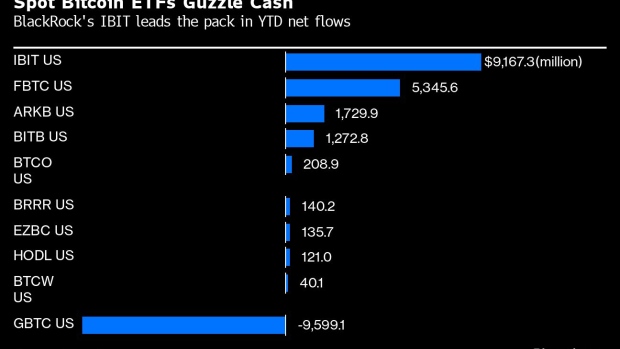

All together, the 10 US spot Bitcoin ETFs that were approved in a historic moment for crypto in January clocked in record volume Tuesday, with over $10.3 billion worth of shares exchanging hands, surpassing a record set last week. The funds have taken in a net $8.5 billion in cash since launching. That’s even with the billions that have been drained from the Grayscale Bitcoin Trust. Fidelity’s FBTC and ARK 21Shares’ ARKB follow BlackRock for the most amount of inflows.

Meantime, products linked to betting against Bitcoin also topped records. The $82 million ProShares Short Bitcoin Strategy ETF (ticker BITI) saw $300 million worth of shares exchange hands Tuesday.

“I think of Bitcoin like the ETF industry, no one gave it a chance until they couldn’t ignore it anymore,” said Mike Cronan, president of ETF Insight, a consulting firm. “It makes a lot of sense that they are linked in their success. Bitcoin is a lot more than just a decentralized currency, it is a network.”

--With assistance from Isabelle Lee and Sidhartha Shukla.

©2024 Bloomberg L.P.