Aug 19, 2020

BlackRock sees value in some pandemic-battered assets

, Bloomberg News

Energy, aviation and lodging firms hit hard by the coronavirus pandemic could offer handsome returns for high-yield investors, according BlackRock, the world’s largest asset manager.

Jim Keenan, chief investment officer and global co-head of credit, said that while it will take years for many sectors to recover, there are still opportunities for discerning money managers.

“You have to consider how long the recovery will take,” he said. “And how will they be able to operate in the meantime in terms of costs and capacity.”

BlackRock sees opportunities in stressed and distressed companies but it’s also offsetting those investments with higher quality names, with more stable cash flow, greater visibility and less exposure to the pandemic. Among those credits are telecommunications, infrastructure and technology firms, Keenan said. BlackRock’s global co-head of credit oversees US$121 billion of assets.

As a general strategy, “we break it down between what we would view as quality income versus more upside total return,” he said.

Healthy Credit

Despite interest rates hovering around zero and central bank asset purchase programs, credit remains a good option for investors to reach their income targets, according to Keenan.

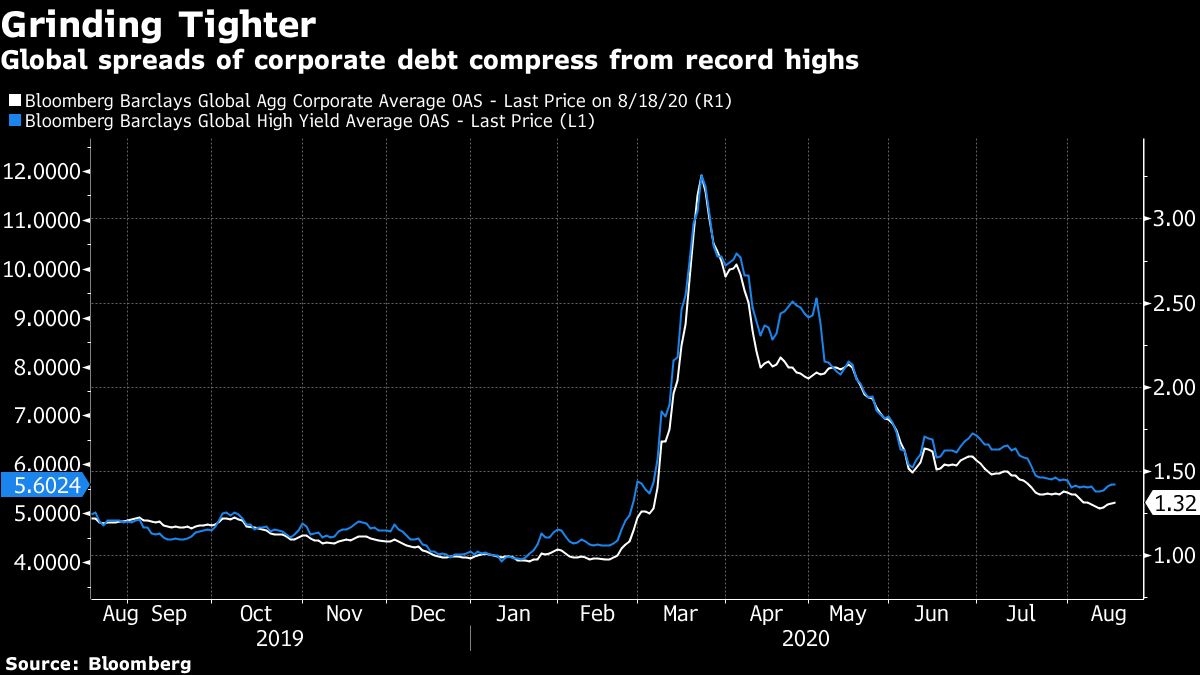

“That level of low rates, significant stimulus, and earnings recovery is going to continue to drive default premiums down and therefore spread compression,” he said. “I think that’s a pretty healthy environment for credit.”

Even with low yields, “there’s still excess return you can get from credit of quality companies that are seeing positive earnings vis-à-vis sitting in cash.”

Safe Bets

BlackRock likes some of the returns an investor can get in high-yield and crossover names in Asia, and the investment firm has shifted more capital to European high-yield and financials.

“Financials have started to look attractive as there is a chance they can reduce their reserve ratios that they took for a potential risk losses,” he said.

In the case of global energy, where BlackRock expects oil prices to stabilize between US$40 and US$50 a barrel, Keenan sees value for investors in the low cost producers and associated infrastructure companies.

“Some of these assets are attractive at these valuations and you can achieve attractive total returns over the next several years,” he said.

Investment Grade

For investment grade companies, BlackRock’s co-head of credit doesn’t expect to see a return of the sell-off in March and April, but he thinks it likely that some outliers will be evident in 5, 10 and 30 year curve returns.

“If you segregate out a few names that had earnings deterioration, I don’t think there is liquidity risk at investment grade at this point,” he said. “The asset class will remain anchored at tighter spread levels.”

After months of low activity, Keenan expects a pick up in M&A activity in the technology, software, and energy sectors as companies look to reduce their supply chain risk and integrate within their local region.

From an income standpoint, “we like some of the private direct lending in the first lien in mid-market, and we’re starting to see M&A come back” he said.