Feb 15, 2019

BOE Rate-Hike Forecasts Pushed Out as Uncertainty Rumbles On

, Bloomberg News

(Bloomberg) -- Economists are pushing back their Bank of England predictions, meaning it’s a close call whether Governor Mark Carney will manage another interest rate hike before he leaves.

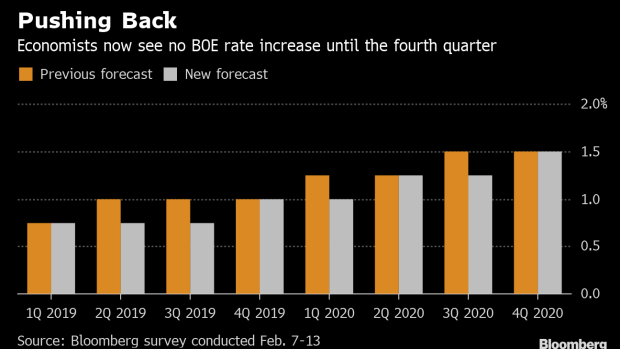

With a Brexit agreement yet to be found, a slew of weaker-than-predicted data and more dovish noises from the central bank, analysts in a Bloomberg survey now see the benchmark rate rising to 1 percent from 0.75 percent in the fourth quarter. They previously anticipated a move before the end of June.

By predicting any move this year, the economists surveyed are still more optimistic than markets, who aren’t fully pricing in any increase until beyond May 2020. That’s after Carney is due to leave the central bank early that year.

In its Inflation Report last week, the BOE cut its 2019 growth projection to the weakest in a decade and predicted a dramatic investment slump. That was followed by a speech by Carney on Tuesday that warned of the “extraordinary situation” of uncertainty faced by U.K. businesses as Prime Minister Theresa May struggles to convince lawmakers to pass her Brexit deal.

The most dovish voice of all though came from policy maker Gertjan Vlieghe, who on Thursday said that even with an agreement, weakness in the British economy and abroad means that a slower pace of hikes will be needed in coming years. The Citi Economic Surprise Index, which measures whether data beat or miss analyst forecasts, has slumped to the lowest level since June.

One possible bright spot for the economy could come from consumers, with data Friday anticipated to show a pickup in retail sales last month.

--With assistance from Jill Ward.

To contact the reporters on this story: Lucy Meakin in London at lmeakin1@bloomberg.net;Harumi Ichikura in London at hichikura@bloomberg.net

To contact the editors responsible for this story: Fergal O'Brien at fobrien@bloomberg.net, Brian Swint

©2019 Bloomberg L.P.