Oct 21, 2022

BofA Says Investor Capitulation Yet to Show Up in Equity Flows

, Bloomberg News

(Bloomberg) -- Equity funds are still seeing inflows despite deeply pessimistic sentiment, with “final capitulation” not yet here, according to strategists at Bank of America Corp.

Global stock funds had inflows of $9.2 billion in the week through Oct. 19, according to a note from the bank citing EPFR Global data. Cash funds saw additions of $14.5 billion, while $12.2 billion left bonds. Gold had redemptions of $1.5 billion, the data show.

The report comes after Bank of America’s fund manager survey earlier this week showed investors had thrown in the towel on equities and global growth. But with inflation remaining persistently high and risks of a recession growing, stock markets have more room to fall, strategist Michael Hartnett wrote in the flows note, dated Oct. 20.

Hartnett said he remains negative “despite ubiquitous bear sentiment,” with global recession and credit shocks just starting.

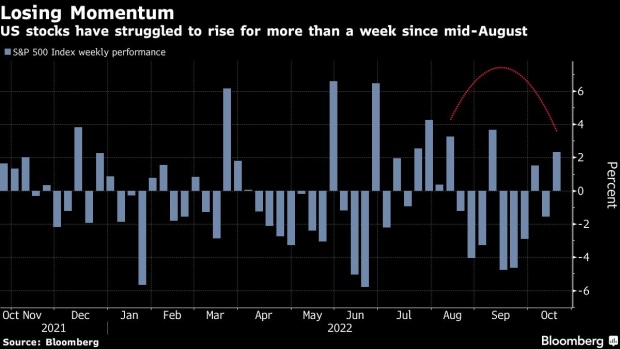

US equities are having a roller-coaster month as investors waver between some signs of resilience in corporate earnings and worries of a staunchly hawkish Federal Reserve and looming recession. The S&P 500 index is set for a weekly gain, but has struggled to rise for two consecutive weeks since mid-August.

Strategists at Citigroup Inc. and Morgan Stanley also warned this week that both earnings estimates and equities have yet to fully reflect the outlook for slowing global growth. Even JPMorgan Chase & Co.’s Marko Kolanovic, who has been Wall Street’s most vocal bull this year, trimmed risk allocations in the bank’s model portfolio as he grows more cautious.

Bank of America’s note showed the exodus from European stock funds continued for a 36th straight week. US funds had a second straight week of inflows at $12 billion.

By trading style, US large cap and value saw additions, while growth and small cap had outflows. By sector, technology and energy had the biggest inflows, while $2.1 billion left materials.

©2022 Bloomberg L.P.