Mar 11, 2024

BofA to Add Headcount, Expand Scope for Transition Business

, Bloomberg News

(Bloomberg) -- Bank of America Corp. plans to expand the scope of its commodity energy transition business, a move it says will require additional headcount as more clients look to reduce their carbon footprint.

The bank is expanding its presence in global gas and power markets as well as in environmental products trading in response to client demand, according to George Cultraro, global head of commodities trading.

Identified by BlackRock Inc. as a “mega” force that’s already driving markets and economies, the energy transition has been widely hailed among financial professionals as a vast money-making opportunity. Banks creating or building out their transition finance desks include Citigroup Inc. in the US and BNP Paribas SA in Europe. European policies targeting carbon markets and renewable energy are proving a particular incentive for the finance industry to monetize decarbonization.

After scaling back its Europe gas and power business in the past decade because of regulatory changes, BofA now sees these as growth markets to which more resources need to be committed.

“Gas is a transition fuel” and “we see opportunity from continuing to trade those markets,” said Brett Orlando, managing director and global head of commodity transition at BofA. The development means the bank is looking to add “a couple of headcount” to Europe, he said.

When it comes to power markets, among other trades, BofA is looking to do more risk management transactions in markets where electricity grids are increasingly being powered by renewable energy, such as in France, Germany, the UK and Spain, Orlando said.

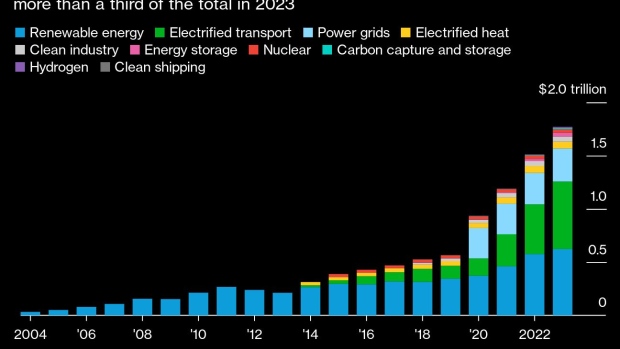

Read More: Energy Transition Investment Trends 2024

For carbon markets, BofA sees “significant growth in compliance market trading, particularly in the EU,” Orlando said. That’s as “policy reforms come into play exposing industrials and now shipowners more directly to carbon pricing.”

In North America, BofA trades the California carbon market, the regional greenhouse gas market in the northeast US, and recently added the Washington state compliance market, he added.

Institutional clients are showing greater interest in index products that offer exposure to the energy transition, according to Orlando. This includes commodities like lithium, cobalt, nickel and copper, all of which are “important for the transition,” he said.

“Institutional investors are attracted to those assets, because they think that demand for those will increase and therefore, value will increase,” he said.

©2024 Bloomberg L.P.