Dec 27, 2023

BOJ’s Ueda Prepares Ground for Rate Hike With Salvo of Comments

, Bloomberg News

(Bloomberg) -- Bank of Japan Governor Kazuo Ueda continued to prepare the ground for the nation’s first interest rate increase since 2007 with another round of comments that further build the case for a move in the spring while not ruling out the less probable option of a January hike.

“It’s possible to make some decisions even if the bank doesn’t have the full results of spring wage negotiations from small- and middle-sized businesses,” the governor said in an interview with public broadcaster NHK released Wednesday.

The latest comments from the governor, in a busy week of signaling from the central bank, suggest the BOJ may be less likely to wait until July to raise rates when more complete pay deal data is compiled by Rengo, the nation’s largest union federation.

Ueda said the chances of having enough information to support a policy change by the central bank’s January meeting were not so high, but he refused to rule out that possibility.

The governor’s remarks are likely to support the view among economists that the central bank will move in April after it has assessed early annual pay deal figures due in March and confirmed the economy is expanding again with gross domestic product data scheduled for release in February.

“As major companies will have made their pay increase decisions by the middle of March, Ueda’s comments yesterday suggest we have a higher chance of seeing an end to the negative rate in April,” said Ayako Sera, market strategist at Sumitomo Mitsui Trust Bank Ltd.

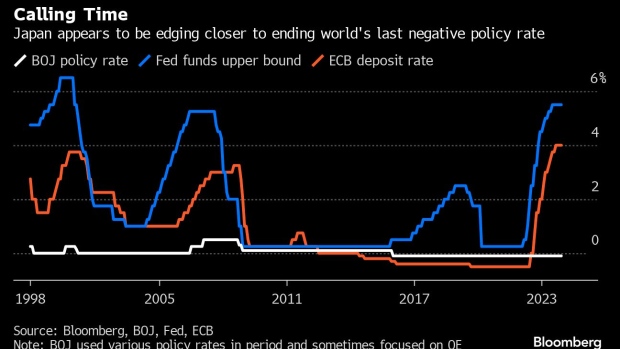

Unlike its peers among advanced economies, Japan has long sought to spur inflation as a way of reinvigorating growth and activity. While the Federal Reserve and the European Central Bank raised rates aggressively to tackle soaring prices, the BOJ has stuck with the world’s last remaining negative interest rate as it tries to fuel a positive cycle of inflation supported by pay gains.

Still, this week’s remarks including Ueda’s speech at the Keidanren business lobby on Monday indicate that the BOJ is edging closer to a decision that would essentially call time on the central banking world’s experimentation with negative interest rates.

Two-thirds of economists surveyed in early December expect the BOJ to raise rates by April. Half of the economists also saw that month as the most likely timing for the move. The latest overnight swaps data put the chances of a January surprise at less than 10% and a move by June at around 89%.

Another possibility is a March hike since Rengo will release the initial results of annual spring pay negotiations known as the shunto the week before the central bank meets. Economists see April as more probable than March since it gives the BOJ more time to look at initial and subsequent pay results.

The central bank also releases its quarterly economic projections in April and these could be used to support the case for a hike. Ueda has tweaked policy at each meeting with quarterly forecasts since he took the helm of the bank last year. Forecasts are also scheduled for release in January.

“Policy change in January is off the table,” said Shoki Omori, strategist at Mizuho Securities Co. “He is going to look at the shunto results as well as the wage trend and income gains in the monthly labor survey and household survey.”

Last year, Rengo announced that 805 unions had secured a record 3.80% wage increase on March 17. For the 2024 pay negotiation, Rengo is set to unveil the first tally on March 15. The BOJ announces its decision on March 19.

The federation then updates the results several times to reflect results from smaller firms. Later tallies released by Rengo in early April this year included results from 1,500 companies with fewer than 300 workers. The corresponding tally will be available on April 4 in 2024.

The pace of wage growth typically tapers off in later tallies as the results of smaller companies are incorporated. Final figures in July edged down to 3.58%.

Ueda’s latest comments did not go unnoticed by the minority of economists predicting a January rate hike.

“My confidence in the scrapping of the negative interest rate in January has fallen a bit,” said Kohei Okazaki, senior economist at Nomura Securities Co.

--With assistance from Mia Glass and Keiko Ujikane.

©2023 Bloomberg L.P.