May 27, 2022

Brace for Crypto Market to ‘Get Weird’ Over Memorial Day

, Bloomberg News

(Bloomberg) --

Cryptocurrencies are probably headed for more bouts of downside volatility and investors should consider reining in their risk, according to Fundstrat.

Buying put protection on long-crypto positions and cutting exposure to more speculative altcoins are a couple of safeguards, Sean Farrell, head of digital-asset strategy at the financial research firm, wrote in a note on Thursday.

Liquidity has been low and could tighten further over the US Memorial Day holiday, while leverage in the Bitcoin market is increasing, according to Farrell. The macro outlook also remains unfavorable to risk assets as the Federal Reserve hikes interest rates and starts quantitative tightening, he said.

“Things could get weird,” Farrell said about the upcoming holidays. The combination of low liquidity, increasing leverage and tightening monetary conditions “could lead to large price swings, and potentially further volatility to the downside in the immediate term.”

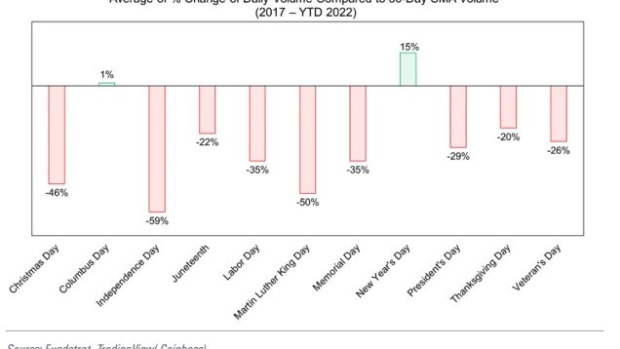

Crypto-market volume dropped 43% and 35% during the Memorial Day periods in 2020 and 2021, respectively, and activity is likely to be “extremely low” again this year, Farrell wrote. With institutional trading largely absent on holidays, “outsized price swings” are possible, he said.

Bitcoin and Ether, the largest cryptocurrencies, are both down about 60% from their record highs in November, and some altcoins are off even more as central banks tighten monetary conditions. The collapse of the so-called Terra ecosystem this month dealt another blow to investor confidence in the asset class.

Even so, Fundstrat expressed optimism about the longer-term outlook for digital assets.

“We remain constructive on cryptoasset prices for 2022 and expect tides to shift” early in the second half, Farrell said.

©2022 Bloomberg L.P.