Oct 24, 2022

Brady Bond Veteran Says Coupon Opt-Outs Vital to Ease EM Pain

, Bloomberg News

(Bloomberg) -- A veteran of 1980s and 1990s emerging-market crises is proposing a bond structure that could give developing nations more fiscal breathing room to cope with their debt burden.

Emerging-market sovereigns in distress should look to a combination of so-called toggle notes and contingent convertible debt, or Cocos, that allow coupon payments to be deferred, according to Carl Ross, partner and sovereign credit analyst at Grantham, Mayo, Van Otterloo & Co.

“What’s in it for emerging-market sovereigns is the ability to get flexibility in times of distress -- when the country is solvent, but needs liquidity relief,” he said in an interview last week. Ross was involved in the Brady Plan restructurings for Mexico and Brazil and was a member of creditor committees for Argentina and Venezuela.

Debt stress is spiraling for developed and emerging governments alike, but since the war in Ukraine, spiking energy and food prices have hit developing nations particularly hard. Nigeria has said it’s looking to extend debt maturities and Kenya’s government plans to renegotiate the terms of loans owed to China.

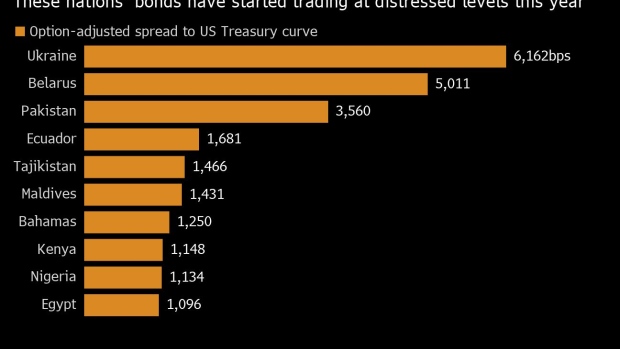

The number of countries with dollar bonds that yield 1,000 basis points or more above US Treasuries has more than doubled since the end of 2021. Investors pulled $76 billion from dedicated emerging-market bond funds so far this year, almost double the outflows from high-yield corporate debt.

“There are several countries negotiating debt restructurings right now,” Ross said. The option of skipping coupon payments “should be part of the conversation in countries like Sri Lanka, Lebanon -- if that ever gets off the ground – and perhaps Zambia,” he said.

Ross has set out the case for what he called “sovereign contingent bonds.” They’re based on toggle notes, which permit debtors to defer coupon payments, usually in return for higher coupon rates in the future, and Cocos, which were designed after the global financial crisis to allow banks to skip coupon payments without defaulting on the debt.

A sovereign Coco with features of a toggle would give an emerging-market issuer the option of skipping two consecutive coupon payments on a single occasion during the life of the bond, Ross said. Coupons would be added to the principal of the bond, and future interest payments would be made on the higher level of principal.

According to Ross, financial losses to bondholders would be negligible, while the country would receive potentially valuable cash flow relief in the event of a shock.

Creative Climate Deals Could Offer Countries Debt Relief: BNEF

One potential objection is that the market would demand a premium for these instruments, potentially putting the finances of the borrower nations in continued stress. That’s a secondary concern for indebted nations in crisis, Ross said.

“When you’re in the midst of a debt restructuring and redoing your bond stack, the yield doesn’t matter quite as much as does the cash flow features of the new debt,” he said.

©2022 Bloomberg L.P.