Jan 5, 2024

Brevan’s Hedge Funds Post Mixed Results, With Digital Currency Strategy Surging 44%

, Bloomberg News

(Bloomberg) -- Brevan Howard Asset Management’s digital currency fund surged last year, while two of its largest hedge funds posted mixed results in a tough trading market for macro money pools.

The $13 billion flagship Master Fund lost 2.1% while Alpha Strategies, which also oversees $13 billion, gained 2.4%, according to a person with knowledge of the matter. The BH Digital Multi-Strategy Fund gained 44%, the person said, asking not to be identified because the details are private.

A representative for the Jersey, Channel Islands-based investment firm, which manages about $36 billion, declined to comment.

Macro traders battled a volatile environment last year as they scrambled to gauge the pace and extent of interest-rate hikes, and the timing of a potential policy pivot. The collapse of Silicon Valley Bank, which sent shock waves across global markets, particularly hurt hedge funds in March 2023.

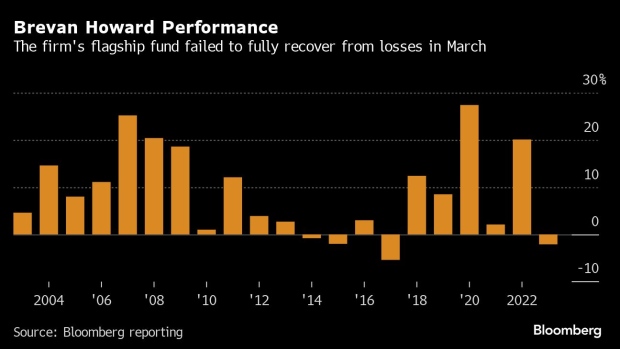

Brevan’s Master fund slumped 4.2% in March last year in its biggest-ever monthly decline since its launch in 2003 and struggled to fully recover from it. The firm also ended a relationship with US hedge fund firm Commonwealth Asset Management after a money pool it advised on suffered losses from bets on short-term interest rates.

Read More: Brevan Howard Ends $1 Billion Commonwealth Strategy After Losses

The Alpha Strategies fund also declined 1.9% in March before a recovery. Both Alpha and Master have grown to become the main offerings of Brevan Howard where multiple traders deploy their assets across strategies with a focus on macro trading.

Brevan Howard, best known for macro trading expertise, started BH Digital in September 2021 and has bolstered the business with capital and staff. The fund, which invests in liquid cryptocurrencies as well as relative-value and venture capital opportunities in the asset class, started in March 2022 and is up 12% since then, the person said.

Here’s a look at 2023 returns for other hedge funds:

--With assistance from Liza Tetley.

©2024 Bloomberg L.P.