Apr 14, 2023

Buffett Focus on ‘Quality’ Helps Narrow Hunt for Value in Japan

, Bloomberg News

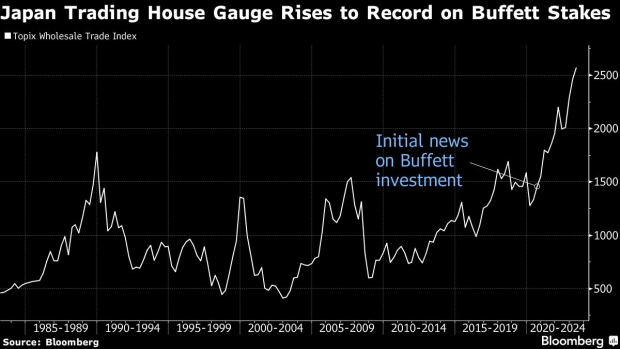

(Bloomberg) -- News of Warren Buffett’s increased interest in Japanese stocks is helping narrow the recent focus on the nation’s value stocks to those that can offer investors more than cheapness.

The Tokyo Stock Exchange stirred market excitement earlier this year by calling on the 1,000-plus Japanese firms whose stocks trade below book to make efforts to improve valuations. Reports this week that the world’s most famous value investor may buy more Japanese stocks trained the spotlight on those whose undervaluation is seen as unwarranted.

“Don’t make the mistake of thinking Warren Buffett is attracted by the large number of Japanese companies trading below book: he clearly said he’s repelled by such stocks,” Nicholas Smith, a strategist at CLSA Securities Japan Co., wrote in a note. “He’s looking for quality, well-run businesses that throw off a lot of cash.”

The Berkshire Hathaway Inc. chief “is most likely to add to what he already owns,” Smith added, referring to the trading houses that Buffett said he has poured more money into recently. The group extended gains Friday, with Itochu Corp. and Marubeni Corp. rising around 4% each to fresh record highs.

Goldman Sachs Inc. also says that companies with poor fundamentals are likely to lose out. It ranks commodities-related names including shipping firm Nippon Yusen KK and Nippon Steel Corp. among the top stocks with high dividends yields, good profit margins and attractive returns on equity, as well as low price-to-book ratios.

“Over the last few days in particular, there has also been a shift in focus toward companies that can offer investors a combination of both value and quality,”strategists Bruce Kirk and Kazunori Tatebe wrote in a report.

JPMorgan Chase & Co. says Buffett is likely to target companies with ROEs that are higher than their cost of equity, as a sign of their quality, in addition to being cash rich and undervalued. It lists Mitsubishi Electric Corp., Dai Nippon Printing Co. and Toppan Inc. among the larger companies meeting these criteria.

“We believe the Japanese economy is undergoing its first structural transformation in three decades and are accordingly bullish on Japanese equities on a global comparison,” strategist Rie Nishihara wrote in a note. Buffett’s “similarly positive view as a long-term investor could help support Japanese stocks going forward.”

©2023 Bloomberg L.P.