Chinese Property Shares Lead Market Rebound as Optimism Rises

Chinese property shares surged, leading gains in the broader market, as sentiment got a boost after a major developer reached a solution with bondholders for its liquidity issues.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Chinese property shares surged, leading gains in the broader market, as sentiment got a boost after a major developer reached a solution with bondholders for its liquidity issues.

New Zealanders who own properties in areas prone to flooding or earthquakes may find they can’t afford insurance or may not be offered cover for specific risks, according to the Reserve Bank.

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Joe Biden’s allies are racing to blunt the presidential campaign of Robert F. Kennedy Jr., casting his third-party effort as a stalking-horse bid designed to boost Donald Trump’s chances — even as his wide-ranging policy positions make him a threat to both.

Chengdu, a major city in the southwest China, removed home-buying curbs, joining dozens of peers in the country in an attempt to revive real estate demand and boost economic growth.

Apr 19, 2022

, Bloomberg News

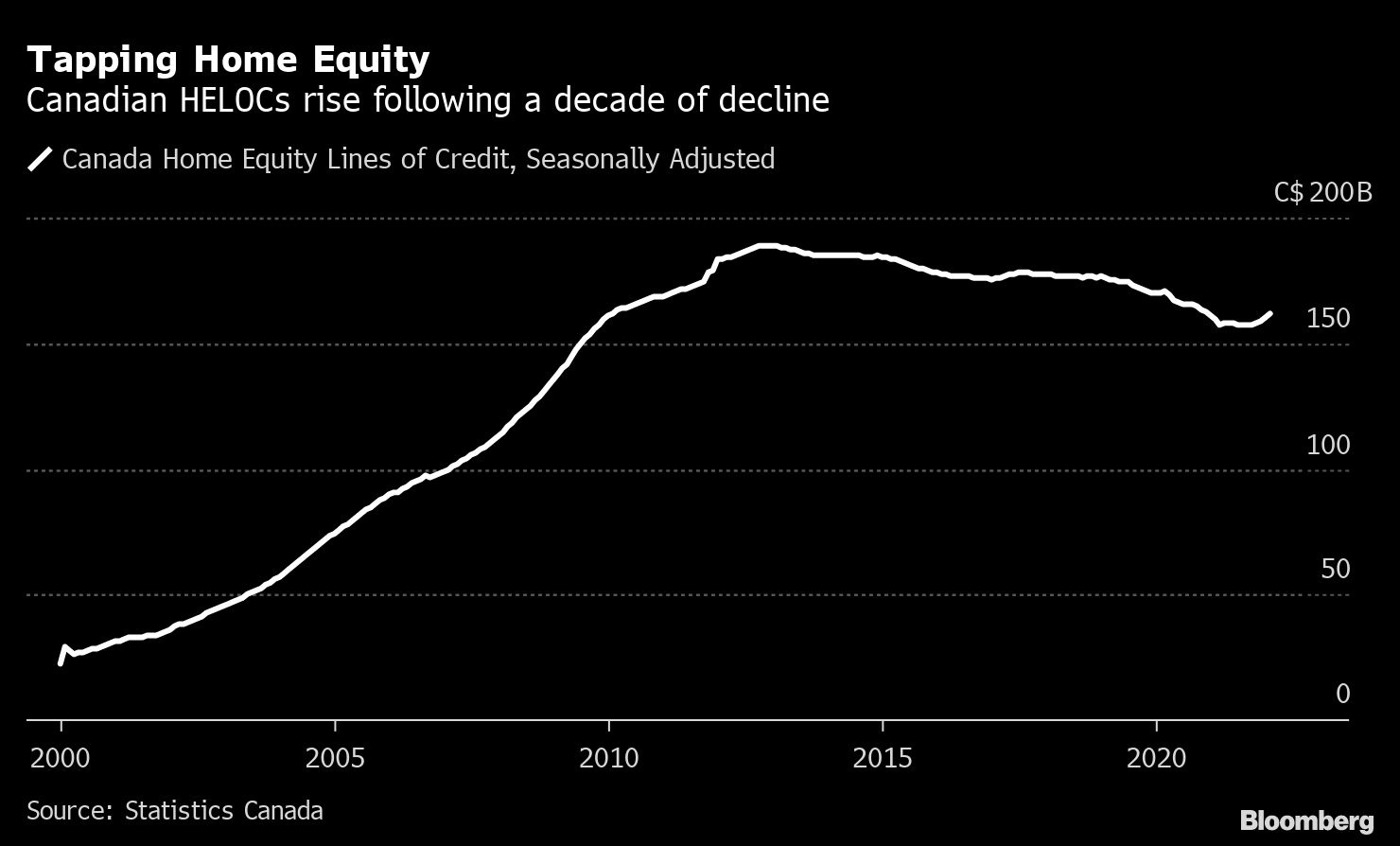

Canadians are increasingly tapping the equity in their homes for loans as higher real estate prices and the loosening of pandemic restrictions encourage spending.

The seasonally adjusted balance of home equity lines of credit rose 1 per cent to $162 billion (US$128 billion) in February, according to aggregate credit data released Tuesday by Statistics Canada. That’s the fastest monthly increase since 2012, capping a fifth straight month of increases.

It’s more borrowing for Canadian households, which are already some of the most indebted in advanced nations, primarily due to large mortgage debts.

While interest rate hikes by the Bank of Canada this year may start to cool a real estate boom that has seen home values surge by 50 per cent in the past two years, prices and sales remain at elevated levels.