Feb 17, 2021

Cathie Wood's 'phenomenal rise' brings ETF assets to US$60B

, Bloomberg News

It’s another milestone for Cathie Wood’s Ark Investment Management.

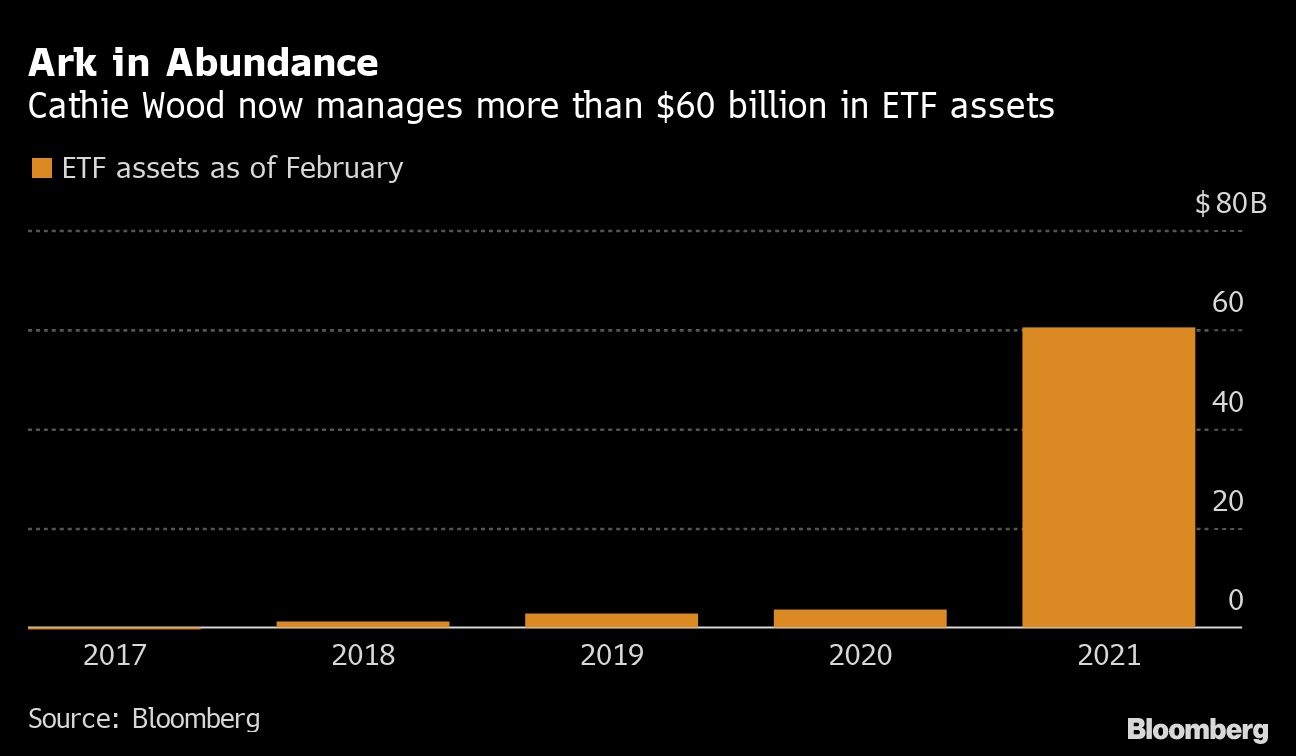

Less than two weeks after hitting US$50 billion in assets, the red-hot firm now manages more than US$60 billion, as funds flow into Wood’s exchange-traded funds at the fastest pace ever. Last week alone, the Ark family added almost US$3.8 billion with five of its funds notching record weeks of inflows, according to data compiled by Bloomberg.

“Ark’s phenomenal rise proved two things: 1. True active management is still alive and well, and loved. 2. The ETF is a tested structure for active management in full transparency,” Linda Zhang, chief executive officer of Purview Investments, said in an email. “Yet very few firms are able to replicate ARK’s success, because truly skilled managers with bold convictions are rare in the industry.”

The continuous torrent of money shows no signs of slowing down, with Wood’s gains further cementing her status as one of this year’s best stock pickers. Her firm is now the seventh largest exchange-traded fund issuer in the US$5.9 trillion industry, one month after first cracking the top 10.

“Investors do not care if active management is inside an ETF or a mutual fund, just that management has been successful in identifying strong growth stocks,” said Todd Rosenbluth, CFRA Research’s director of ETF research.

Wood’s selection of innovative companies has driven her flagship US$28 billion ARK Innovation ETF (ARKK) up more than 24 per cent this year, compared to 4.7 per cent for the S&P 500. At the same time, her ARK Autonomous Technology and Robotics ETF (ARKQ) has gained 29 per cent.

What a difference a year can make. This time in 2020, Ark managed just US$3.6 billion in ETF assets.

Some view that unrelenting influx of cash as less than ideal. After all, there are only so many future-focused companies that fit within Wood’s themes like genomics and robotics, and her concentration risk rises with every new dollar deployed into the same stocks.

“It means that it’s going to be very difficult to maintain their returns,” said Matt Maley, chief market strategist at Miller Tabak + Co. “When a fund gets extraordinarily big, it’s hard to find enough good ideas where they can invest all that money.”

For now, Wood’s products continue to be inundated with fresh money, beating out every other firm in the industry besides Vanguard Group for inflows year-to-date. And unlike mutual fund managers, Wood can’t close any of her products to new entrants.

“With the ETF structure, there are no limitations in terms of taking in capital,” said Nate Geraci, president of the ETF Store, an advisory firm. “As long as Cathie Wood is going to leverage the ETF structure, investors can continue putting money into that structure.”