Mar 13, 2023

CATL’s EV Battery Dominance Shouldn’t Cause Xi Undue Worry

, Bloomberg News

(Bloomberg) -- Contemporary Amperex Technology Co. Ltd. is truly the undisputed electric vehicle battery-making king. It supplies a roll call of carmakers — from Tesla Inc. to Ford Motor Co., Volkswagen AG to Hyundai Motor Co. and Stellantis NV — and commands a 37% share of the market globally. Net income almost doubled last year to $4.4 billion.

Its might has even caught the attention of China’s highest upper echelons, with President Xi Jinping last week expressing “both joy and worry” about CATL ranking as the world’s biggest cell maker for six years straight.

“The good news is that our industry has come to the forefront of the world. The worry is that I am afraid of a big boom, first rushing up, and finally dispersing,” Xi was quoted as saying by Xinhua News Agency. (Interestingly, Fujian province, where CATL is based, is also where Xi spent 17 of his emerging years in a variety of politically appointed roles through 1985 to 2002, according to China Vitae.)

Xi’s worries stem from CATL being too big to fail — a risky proposition at a time geopolitical tensions between China and the US are running high. But China’s supreme leader, who just secured a norm-defying third term in office, needn’t spend too many sleepless nights fretting over CATL’s outsize position. That’s because there’s a veritable sea of smaller EV battery makers under CATL that are just as ambitious.

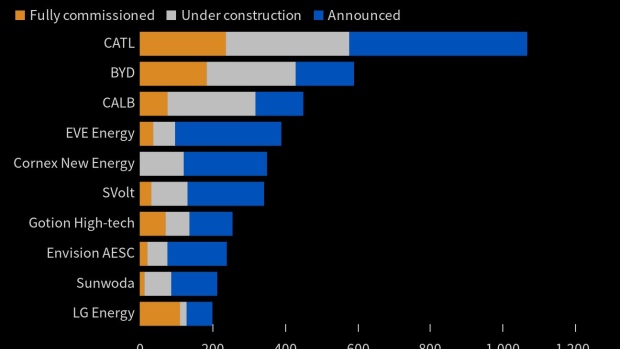

From recently listed CALB, which aspires to be a top-three global player in five years, to Gotion Hi-Tech Co., Sunwoda Electronic Co. and Farasis Energy Gan Zhou Co., there are a heap of lesser-known Chinese cell manufacturers with an eye on CATL’s clients. China also has another battery heavyweight in BYD Co., which according to SNE Research ranks an equal second with South Korea’s LG Energy Solution Co. A big automaker itself, it mostly supplies batteries for its own electric cars.

“CATL does hold a large share, but there’s room for other producers,” Benchmark Minerals Intelligence Ltd. analyst Evan Hartley said. Benchmark expects CATL’s share of global production falling to 13% by 2030. It would still be the world’s largest player in terms of capacity, but no longer an 800-pound gorilla.

Bloomberg New Energy Finance also sees a wave of new Chinese producers coming to the fore, with the country’s under-construction and pledged capacity growing around 3.5 times current levels to 6,668 gigawatt hours by 2030, or about 69% of predicted global production.

“Automakers don’t want a single supplier,” BNEF analyst Siyi Mi points out. “It’s not good for negotiating battery supply prices. That’s why automakers are bringing supply in-house or trying to partner with smaller players to break up the monopoly.”

One striking change forecast by BNEF is the rise of little-known Cornex New Energy, a Wuhan, Hebei-based company that’s building out 120 gigawatt hours of capacity and plans another 230 more. If those bold ambitions are realized, Cornex would be bigger than LG Energy Solution or Japan’s Panasonic Holdings Corp.

Of course, some level of consolidation is to be expected, and overcapacity may result in price weakness that would impact even the largest companies, including CATL. Manufacturers may also fall short of their capacity targets — for all its talk, Cornex has zero production at the moment, for example.

But with money still flowing into the sector — Michigan-based battery startup Our Next Energy closed a $300 million Series B funding round at a valuation of $1.2 billion last month — CATL’s competitor ranks keep swelling. While CATL will likely remain a dominant force for years to come, its position won’t be unassailable, and at least its rivals will largely also be Chinese. All that should spark more joy than worry for Xi.

©2023 Bloomberg L.P.