Apr 13, 2023

Chevron to Outperform Exxon as Oil Prices Rise, Scotiabank Says

, Bloomberg News

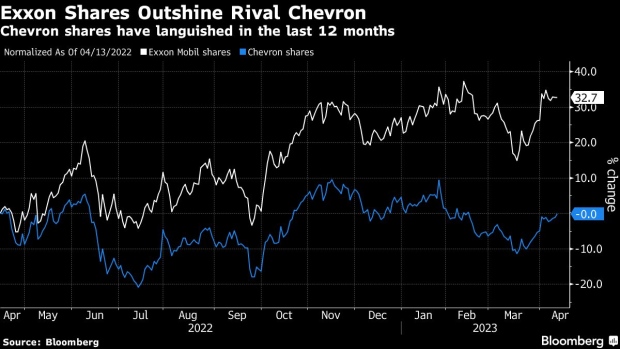

(Bloomberg) -- Chevron Corp. shareholders have had to watch with some envy while the oil and gas producer’s biggest rival, Exxon Mobil Corp., has soared and hit fresh highs over the last year. Scotiabank thinks their roles could soon reverse.

Exxon has been the second-best performer in the S&P 500 Energy Index over the last 12 months, rising 33% and towering over its smaller rival, Chevron, whose shares have been little changed in the same period. But as oil prices climb and refining margins are potentially squeezed, analysts see Chevron shares hitting an all-time high.

Scotiabank analyst Paul Cheng upgraded Chevron to outperform from sector perform and hiked the price target on the stock from $195 to $200 — a Street high. The average Wall Street price target on Chevron is now $190, which would also be a record for company, according to data compiled by Bloomberg.

Betting on rising oil prices, he wrote in a Thursday research note that Chevron could perform better than Exxon given its “higher oil leverage following the OPEC+ latest production cut announcement.”

At the same time, Cheng downgraded Exxon to perform from outperform because the company has much larger refined product exposure that could “be a drag on earnings given our view that the refining market could reach an inflection point in the second half of April,” he wrote. There’s also Exxon’s “deal risk” from its reported interest in buying Pioneer Natural Resources, he added.

©2023 Bloomberg L.P.