Apr 10, 2023

China AI Stocks Sink on Call for Beijing to Rein In Bubble Risk

, Bloomberg News

(Bloomberg) -- Chinese shares related to artificial intelligence plunged after a state media outlet urged authorities to step up supervision of potential speculation.

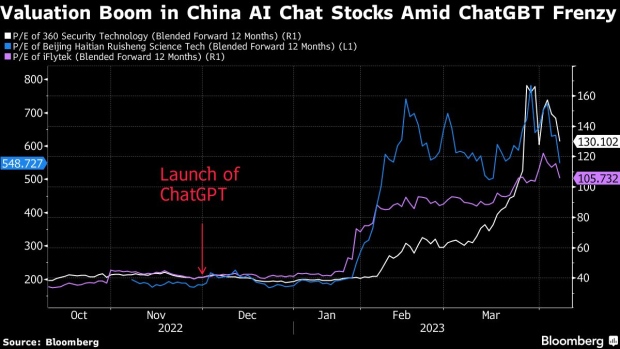

The ChatGPT concept sector has “signs of a valuation bubble,” with many companies having made little progress in developing the technology, the Economic Daily wrote in a commentary Monday.

Regulators should strengthen monitoring and crackdown on share-price manipulation and speculation to create “a well-disclosed and well-run market,” according to the newspaper, which runs a website officially recognized by Beijing. Companies, it said, should develop the capabilities they propose, while investors should refrain from speculating.

CloudWalk Technology Co. tumbled a record 20%, while 360 Security Technology Inc. dropped by 10%, the most in three years. Beijing Haitian Ruisheng Science Technology Ltd. sank 15%. Baidu Inc. dropped 3.5% in New York trading.

Since the release of ChatGPT, Chinese shares related to the technology have surged, with domestic big techs joining the race to develop generative AI. SenseTime Group Inc. last Tuesday rose the most in two months in Hong Kong amid speculation that the SoftBank Group Corp.-backed company was developing a product to challenge ChatGPT. Shares of Alibaba suppliers also jumped on reports that the tech giant will unveil its answer to ChatGPT.

“Generative AI is the hottest trend now and many tech companies will be launching their own versions in the coming months,” said Vey-Sern Ling, managing director at Union Bancaire Privee. “While valuations may rise to such news, the actual financial impact to these companies may be difficult to gauge at this juncture, and may lead to disappointment eventually.”

(Adds Baidu share move in fourth paragraph)

©2023 Bloomberg L.P.