Aug 26, 2022

China’s Bad Debt Funds Are No White Knights in Property Crisis

, Bloomberg News

(Bloomberg) -- China’s bad-debt managers, pegged just six months ago as potential white knights to the crumbling real estate sector, have turned out to be part of the problem.

Aggressive lending to embattled developers during the sector’s boom years has beset the $730 billion funds with heavy credit losses, sending their bonds tumbling and forcing Beijing to weigh a preliminary plan to restructure the sector, according to people familiar with the matter.

The troubles at China’s four largest managers of soured loans have worsened as the real estate crisis deepened this year, meaning they are unlikely to rescue the sector until they get their own finances in order.

The savior role is one the asset management companies, or AMCs, were set up to play in the wake of the Asian financial crisis as Chinese banks teetered on the brink of collapse. The biggest -- China Huarong Asset Management Co. -- typified the rot that later set in when it was forced to accept a 42 billion yuan ($6.1 billion) bailout last year and its chairman was executed for crimes including bribery.

The funds “can’t go on rescuing China’s property market this time,” said Victor Shih, author of “Factions and Finance in China: Elite Conflict and Inflation.” “Their own balance sheets are already so saddled with bad debt, they simply don’t have the ability to digest more.”

As recently as February regulators were looking to the AMCs as a solution to the crisis, calling on Huarong and China Cinda Asset Management Co. to help restructure weak developers, acquire stalled property projects and buy soured loans.

These same funds took trillions of yuan of bad loans off the balance sheets of the four biggest banks two decades ago. Once stability was restored, the funds, with combined assets of more than 5 trillion yuan, branched out to new sectors ranging from insurance to brokerages, and increasingly real estate.

Property Exposure

The four big managers -- Huarong, Cinda, China Great Wall Asset Management Co., and China Orient Asset Management Co. -- have lent money to the majority of the country’s top 50 developers over the years. Cinda and Huarong alone have more than 200 billion yuan in exposure, and property accounts for nearly 50% of the acquisition and restructuring businesses at Cinda and Huarong, according to their filings.

“Instead of fulfilling their mandate to clean up bad loans and fade away, they just became progressively more adventurous in their funding and structuring, exacerbating the non-performing loans they were set up to dispose of,” said George Magnus, author of “Red Flags: Why Xi’s China is in Jeopardy.”

One of the most lucrative opportunities was indirect lending to property companies. The money managers would take over loan and bond obligations on the premise that the builders would buy them back at a premium of 10%-12%, according to a person familiar with the investments. That worked in an upward cycle as the developers used the money to buy more land and generate revenue by selling apartments that increased in value.

The shift to real estate increasingly turned the AMCs into shadow banks. In one recent example, Huarong channeled money to distressed developer Citychamp Dartong Co., charging 11% interest, according to a June filing. That’s well above Huarong’s own borrowing costs of about 4.5%, resulting in a handsome spread.

“The AMCs essentially were loan sharks,” said Hao Guanghui, president of Suiyong Rongxin Asset Management Co., a Shanghai-based private bad-debt manager. “They were giving out loans in the name of asset acquisition and restructuring, that’s why they are called shadow banks.”

The music stopped when China implemented stringent measures to curb developers’ debt, depriving them of their growth engine just as Covid lockdowns curbed home sales and prices and sapped consumer confidence.

Now the AMCs are paying the price for their real estate bets. Huarong, the biggest fund, is expecting an 18.9 billion yuan loss for the first half of the year due to credit impairments, prompting Moody’s Investors Service to put it on review for a possible downgrade. Huarong and Cinda are scheduled to report full results Monday.

The loss pushed some of Huarong’s dollar bonds to below 80 cents on the dollar, from par earlier this year, while its shares have fallen 70% this year in Hong Kong. The collapse comes just nine months after Huarong received a state bailout with an equity injection led by Citic Group Corp.

Smaller rival Cinda warned in July that net income could drop by 30% to 35% in the first half, while Great Wall on Friday posted a net loss of 8.56 billion yuan for 2021 -- four times higher than the previous year -- after missing a June deadline to report results. Bonds sold by Cinda, Orient and Great Wall have tumbled to around 80 cents on the dollar. The AMCs face about $20 billion in debt maturities onshore and offshore before the end of 2023, according to Bloomberg-compiled data.

Sector Overhaul

Beijing is now looking to overhaul the sector, as first reported by Caixin in March. The latest moves could see state-backed entities take over three of the firms, according to people familiar with the measures, asking not to be identified discussing a private matter. The plan is in early stages and could change or be scrapped, they said.

One solution under consideration would be to have state-owned China Everbright Group acquire Great Wall while China Orient and Cinda would be merged, the people said.

If the overhaul takes place after the Communist Party Congress this year, the aim in the long run would be for a combined Cinda and Orient to become the only bad-debt manager with a nationwide operation to deal with distressed assets, people familiar said. Huarong and Great Wall would focus on handling the non-performing loans of their new parents -- Citic and Everbright.

The Ministry of Finance and the AMCs didn’t respond to requests for comment.

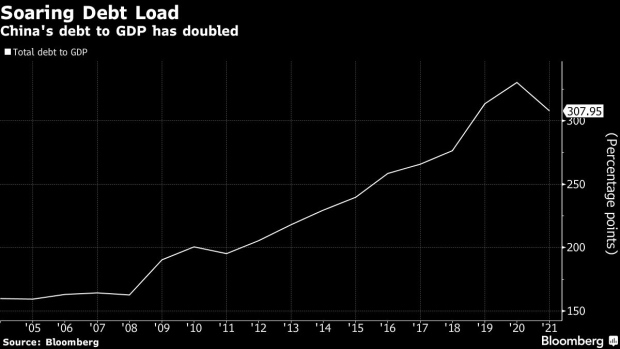

Any state injection into the AMCs could add further strain to the nation’s finances. China’s debt to gross domestic product is already at 308%, a risky level that curbs the government’s ability to issue more stimulus, said Shih.

What’s more, China’s ability to outgrow its debt is weakening. In the early 2000s, with more than 10% nominal growth in the economy, the ratio of debt to GDP would shrink by 75% over 14 years or less, said Carsten A. Holz, a professor of economics at Hong Kong University of Science & Technology.

“At today’s much lower growth rates, bad debts are a serious issue, eventually leading one to question financial stability in China,” said Holz.

©2022 Bloomberg L.P.