Aug 21, 2022

China’s Banks Trim Lending Rates to Reverse Slump in Borrowing

, Bloomberg News

(Bloomberg) -- Chinese lenders lowered their benchmark rates and the central bank urged them to maintain steady loan growth as Beijing deploys more levers to alleviate a worsening housing crisis.

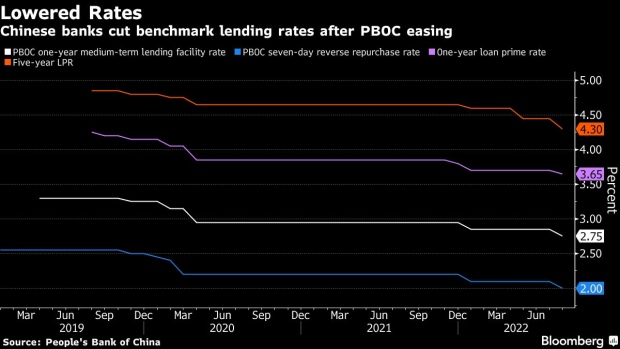

The five-year loan prime rate, a reference for mortgages, was reduced by 15 basis points to 4.3% after being cut by the same magnitude in May. The People’s Bank of China on Monday urged lenders, especially major state-owned banks, to boost loans to the real economy. The moves follow Friday’s announcement of special loans being offered to property developers in a program that could be worth 200 billion yuan ($29.3 billion), according to people familiar with the discussions.

China is taking drastic action to help a real estate market beset with problems. Home sales continue to plunge, property investment is contracting, cash-strapped developers are struggling to complete projects and homebuyers are boycotting mortgage payments.

The special loans for developers would be the biggest financial commitment yet from Beijing to contain the crisis. The funds will be channeled through China Development Bank and Agricultural Development Bank of China, according to the people, who asked not be identified discussing private information.

Read More: China Plans $29 Billion in Special Loans to Troubled Developers

The PBOC also cut its one-year loan prime rate on Monday, lowering it by a smaller-than-expected 5 basis points to 3.65%, the first decline since January. The drop in the LPRs followed the central bank’s surprise move last week to lower the rate on its one-year policy loans by 10 basis points.

“We’ve already reached the point where the central government really needs to step in,” said Hyde Chen, head of strategy and asset management for Haitong International, in an interview with Bloomberg TV. With the housing market contributing around 20-30% of gross domestic product, it’s become an “elephant in the room.”

“They really need to provide a backstop, to provide confidence that a housebuyer can say, ‘OK, the house I bought can be delivered’,” he added.

China’s benchmark CSI 300 Index of stocks closed 0.7% higher on Monday, the first increase in three sessions, as Asia equities broadly fell. A gauge of real estate developers jumped 1.1%.

While lower borrowing costs could help spur demand for loans, it’s unlikely to reverse the sharp slump in confidence.

The weighted average interest rate for newly granted mortgages already plunged in June to 4.62%, the lowest level since 2017. The reduction in the five-year LPR will likely push average mortgage rates down further, as the floor for minimum mortgage rates is set at 20 basis points below the rate.

Macquarie Group Ltd. economist Larry Hu estimates the average mortgage rate may fall to 4.3% in the third quarter. A large drop of that magnitude in the mortgage rate in such a short time is “unprecedented,” he said.

The PBOC on Monday said that in addition to supporting the real economy, banks should enhance credit support for small- and micro-enterprises, green development, scientific and technological innovation and other fields, according to the statement.

“We must consolidate the foundation of economic recovery and development with a sense of urgency that no time can wait,” it said.

The gap between the cut in the one-year and five-year loan prime rates suggests a desire by banks to boost demand for property and mortgages while keeping short-term borrowing costs relatively steady. Banks need to preserve profits, as their average net interest margin narrowed this year due to monetary policy easing and low borrowing demand.

Banks are flush with cash, but are either unwilling or finding it difficult to finance projects. Credit demand weakened sharply in July, prompting some economists to warn of a “liquidity trap” in China, where low interest rates fail to spur lending in the economy.

What Bloomberg’s Economists Say ...

“Monetary easing alone may not be sufficient to revive demand, which has been shattered by the housing slump and Covid Zero restrictions. Restoring business and consumer confidence will probably require a more significant policy reorientation.”

-- Eric Zhu, economist

Read the full report here.

The PBOC, meanwhile, also has the task of guiding monetary policy and making sure the economic recovery is on track while keeping an eye on inflation, which in July accelerated to the highest level in two years.

“A more cautious reduction in the one-year LPR can avoid bringing further inflation pressure” considering liquidity in the economy is still flush, said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc.

He added that the PBOC may take additional steps, including cutting the amount of cash banks have to keep in reserve as a way to replace maturing policy loans and lower banks’ funding costs.

The recent policy actions “are clearly more aggressive than before,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “Authorities are aware the stress build-up [in the property sector] imposes quite high macro risk, so they need to take action quickly and aggressively to address those problems.”

The LPRs are based on interest rates that 18 banks offer their best customers and are quoted as a spread over the central bank’s rate on its one-year policy loans, known as the medium-term lending facility.

(Updates with central bank moves in first paragraph.)

©2022 Bloomberg L.P.