Feb 23, 2023

China’s ChatGPT Stock Frenzy Cools Amid Reported Regulatory Ban

, Bloomberg News

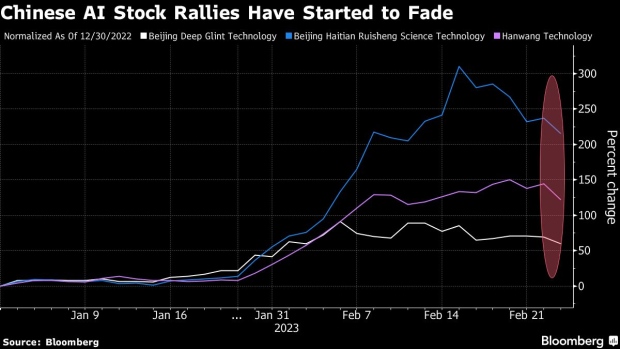

(Bloomberg) -- The rally in Chinese artificial intelligence stocks is showing further signs of cooling amid media reports of authorities banning access to OpenAI’s ChatGPT service.

Local apps and websites have been ordered to terminate services that allow use of ChatGPT, according to stories in various Chinese and foreign publications over the past couple of days, some of which have since been deleted. OpenAI’s chatbot isn’t officially available in China but has been accessible via virtual private networks.

Shares of Beijing Haitian Ruisheng Science Technology Ltd. dropped as much as 8.5% Thursday, paring its more than 200% gain on the year. Hanwang Technology Co. slid by as much as its 10% daily limit after more than doubling in the past month. Beijing Deep Glint Technology Co. continued to trim its big advance since saying earlier this month that it lacks the ability to offer ChatGPT-related services.

The reported ChatGPT ban tallies with Beijing’s longstanding mistrust of foreign technology, as evident in its prohibition of sites such as Twitter and Facebook. It’s also seen as offering a chance for local companies like Baidu Inc., which are now racing to introduce AI-related technology that could be approved by the government. Baidu’s shares rose as much as 1.6% in Hong Kong on Thursday.

Read more: Baidu Surges as Hope Mounts Over Chinese Answer to ChatGPT

“This will be very positive for Baidu,” said Steven Leung, executive director at UOB Kay Hian (Hong Kong) Ltd. More broadly, investors may be “somewhat wary of Chinese regulators putting more restrictions on the development of AI and ChatGPT-related technology.”

Some high-flying stocks have begun to wobble as Beijing makes the public aware of its displeasure with ChatGPT. Earlier this month, Chinese newspaper Securities Times warned investors in a front-page commentary not to blindly join the speculative rally.

“ChatGPT could provide a helping hand to the US government in its spread of disinformation and its manipulation of global narratives for its own geopolitical interests,” state-owned media outlet China Daily wrote Monday in a post on Weibo, a local Twitter-like social media platform.

©2023 Bloomberg L.P.