Feb 22, 2024

China’s Consumer Startups Fight for Survival as Demand Falters

, Bloomberg News

(Bloomberg) -- China’s economic malaise is taking down some of its rising consumer startup stars, which had been hyped as the country’s replacement for Western brands from Coca-Cola Co. to Haagen Dazs Co.

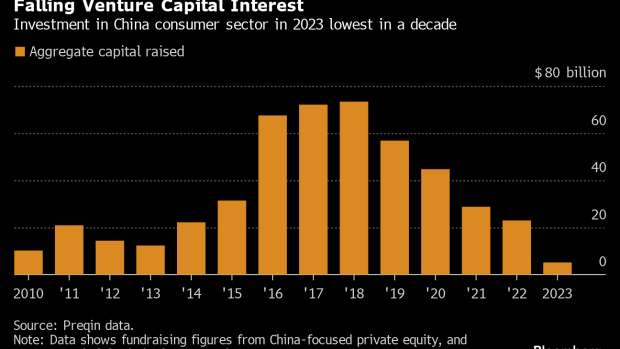

Instead, firms like drinks maker Chi Forest and ice cream brand Chicecream are seeing their fortunes turn as venture capital investment into the country’s consumer sector plunged 93% last year from 2018’s peak, according to data provider Preqin Ltd.

Meanwhile, companies that listed before the downturn — including cosmetics maker Yatsen Holding Ltd., toy company Pop Mart International and tea and baked goods producer Nayuki Holdings — have since slid more than 80% from their IPO prices.

The shift has burned investors like Temasek Holdings Pte and Warburg Pincus, whose interest helped up-and-coming mainland brands shoot to fame via slick marketing appealing to a growingly nationalistic middle class. Now, many are struggling to stay afloat, with layoffs and legal tangles mounting.

“China’s new consumer brands managed to see high-flying growth in recent years at exactly the right time, right place and among the right consumers,” said Roolee Lu, Shanghai-based associated director of consultancy Mintel Group Ltd. “Now the golden time of high growth is in the past for them.”

Read More: China’s Bruised Middle Class Has Bad News for Global Brands

Chi Forest, formerly known as Genki Forest, is a case in point. The maker of sugar-free sparkling waters and teas saw its valuation reach $15 billion by its last funding round, becoming the top Chinese FMCG brand on Hurun’s global unicorn list. But as China went through strict Covid lockdowns that kept people at home, it fell short by as much as 30% of its sales targets of 7.5 billion yuan ($1 billion) and 10 billion yuan in 2021 and 2022, respectively, according to people familiar with the matter.

Total sales last year were less than 7 billion yuan as its fizzy water division posted declines, the people said, and products were put on sale. More than 50% of the product department was let go in 2022, and layoffs continued through last year, they said, despite onetime ambitions to eventually double the team.

A slowing economy and pullback in consumer spending are shrinking demand for premium goods, exposing the weak foundation of China’s newer brands. Their struggle to provide sustainable alternatives to Western brands is a setback for China’s ambitions to boost local companies amid rising tensions with the US, Australia and Western Europe.

Established global companies have stronger supply chains and extensive distribution networks, allowing them to charge less than their nascent rivals. And they’ve been able to introduce new lines to compete, from Coca-Cola’s own line of sugarfree sparkling waters — including Chi Forest’s biggest-selling flavors, like peach and grapefruit — and Pepsi Co.’s debut of its no-sugar product, Raw Cola.

Competition is stiff within Asia, too. Chinese heavyweight Nongfu Spring Co.’s tea segment grew 60% in the first half of 2023, contributing more than a quarter of total revenue. Suntory Holdings Ltd.’s sugar-free Oolong tea saw 200% growth in the same period. Both brands sell their sugarless teas at price points close to similar drinks from Chi Forest.

When asked for comment, Chi Forest referred Bloomberg to a Feb. 4 letter sent to employees by founder Tang Binsen. Tang called the external environment “tough,” saying it had made many firms arrive at a point of deciding whether to exit the market.

“We’ve been learning from industry veterans in the past years and gained understanding via trials and errors,” he wrote. “One of the big takeaways for me is that we made some achievements during the early days because of luck, and we were smug on that, including myself. When you are smug, it’s easy to make mistakes.”

‘In Trouble’

Other startups have been forced to reduce their prices, or close up shop all together.

Premium ice cream brand Chicecream once benefitted from rising nationalism by causing a frenzy for bars shaped like the tiles widely used in ancient Chinese houses. It was the top ice cream seller in online shopping festivals in 2021, pricing items at as much as 66 yuan in a market where most topped out at 10. Last year, as consumers shifted to budget friendly options, the company introduced a 3.5-yuan ice cream.

Pastry chain Tiger Attitude, which charged 20 yuan for goodies such as its social media-friendly tiger rolls, had backers like HongShan, formerly Sequoia China. But its 80-store network across 10 cities shrank last year as business weakened. Now it’s faced with lawsuits from former staff citing unpaid wages and suppliers asking for money they say they were never paid, according to legal documents on Chinese platform Tianyancha, which tracks companies’ registration information.

Workout chain FineYoga, where people once dropped 800 yuan per class, shut its studios last year citing cash flow issues and a failure to raise more funds.

Calls for comment to Chicecream, Tiger Attitude and FineYoga went unanswered.

Meanwhile, for Chi Forest, consumers’ pullback has brought its goal of becoming China’s version of Coca-Cola to a crashing halt. Some hyped releases, like a cola-flavored sparkling water meant to challenge the US giant, are discounted on shelves across China.

“Many new consumer startups are in trouble now,” said Jason Yu, managing director of Kantar Worldpanel Greater China, which tracks spending behavior. “Without sustainable product innovation, competitive supply chains and good value for money, there’s no reason for consumers to keep spending on them.”

©2024 Bloomberg L.P.