Mar 13, 2021

China’s Plan to Trim Debt Makes Stock-Market Reforms More Urgent

, Bloomberg News

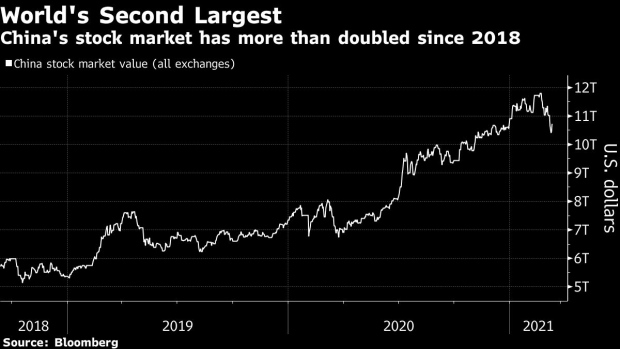

(Bloomberg) -- China’s policy makers, spurred to act by ballooning debt, are trying to get the country’s $10.7 trillion stock market to play a larger role in funding the economy.

Top officials meeting in Beijing last week said they would push ahead with more equity-market reforms in 2021, accelerating a campaign aimed at encouraging more share sales from local firms. Initiatives like new hedging tools or widening the daily price limit on stocks could boost liquidity and help attract foreign capital, at a time when China’s mutual fund investors are being blamed for rising stock volatility. Capital-market reforms will promote a more “mature investment culture,” local media reported Friday, citing delegates of the National People’s Congress.

Authorities have signaled the cost of borrowing will rise as the economy gains traction, putting the spotlight on the stock market as an alternative source of funding. While multiple interest-rate cuts and cash injections from the central bank helped keep Chinese companies afloat last year, the quick buildup of debt now poses a significant risk to the financial system. Officials have warned about asset bubbles, with the banking and insurance regulator saying this month that speculation in the property market is “very dangerous.”

Measures under consideration include changing the system for initial public offerings on main exchanges in Shanghai and Shenzhen, a move that could reduce the backlog of hundreds of companies waiting to list. And as authorities loosen control over the stock market, they’re getting tougher on firms that want to access it: the securities regulator may set a higher bar for companies looking to sell shares on its experimental Star venue.

Below is an overview of some of most significant changes currently in the works for China’s stock market.

Swing away

The majority of China’s 4,000-odd stocks can move a maximum 10% in either direction, or 5% for companies with troubled finances. The single-stock restrictions have been relaxed in two of China’s experimental trading venues: in August, the cap was doubled to 20% for shares on Shenzhen’s ChiNext after the system was tested in Shanghai’s Star board. The next step is to deploy those changes to the cities’ two main boards.

- Market impact: A wider trading band could encourage more active trading, which improves market liquidity. But expanding the band to the main boards leaves China’s biggest and most-owned companies vulnerable to extreme moves -- and its fund managers susceptible to redemptions.

Cutting red tape

China plans to expand a pilot program on a registration-based system for initial public offerings to all of its trading venues. First-time share sales on the main Shanghai and Shenzhen stock exchanges are currently vetted by the regulator, a lengthy review period which makes the equity market inaccessible for many smaller companies. The system was adopted by the Star board in 2019 and implemented on the ChiNext in 2020.

A plan to merge Shenzhen’s main board with its smaller enterprise board, announced in February, was seen as a step toward a broader rollout. The securities regulator said last month that the trials are under review, and is looking to push forward the reform steadily and in an orderly fashion.

- Market impact: A more accessible and efficient primary market, where the valuation is determined by investors. The regulator imposes an unofficial cap of 23 times earnings for IPOs, which limits fundraising. As of late January, there were more than 800 companies lining up to list in China, according to data compiled by Bloomberg. After filing an application, it takes on average 522 days to debut, Huaan Securities Co. estimated in a recent note. The ChiNext’s registration-based system cut that to 107 days, according to the brokerage.

No hedge no edge

International investors have been reluctant to increase their exposure to onshore stocks because of a dearth of hedging tools like futures and options, and this was one of the four concerns raised by MSCI Inc. in 2019. Authorities clamped down on derivatives after they were blamed for exacerbating the stock crash in 2015. Yi Huiman, chairman of the China Securities Regulatory Commission, has said that developing the derivatives market “steadily” is a top priority.

- Market impact: Looser restrictions on index futures would help attract overseas inflows. Futures are one of the easiest, cheapest and most-liquid ways to hedge positions, making them essential risk-management tools for professional funds. But the products are also targeted by speculators, which can trigger margin calls if the cash market moves against a big leveraged bet.

Buy now, sell now

Unlike the U.S. and Hong Kong, China’s stock market carries a T+1 trading mechanism, meaning investors can only sell their stocks the day after purchase. Xiao Gang, former chairman of the securities regulator, said in August that China could pick blue-chip stocks for same-day trading trials, after the Shanghai Stock Exchange said it’s studying a partial “T+0” trading mechanism for its Star board. Still, the CSRC indicated last month that implementation is a long way off, saying market participants are still cautious.

- Market impact: A T+0 trading mechanism is favored by speculators and high frequency traders because they can profit from intraday fluctuations. While that helps increase liquidity -- a good thing if you want efficient markets and better price discovery -- it can also make stocks more volatile.

©2021 Bloomberg L.P.