Feb 25, 2024

China’s Weak Local Borrowing Raises Hope for More Central Aid

, Bloomberg News

(Bloomberg) -- China’s local governments so far appear reluctant or unable to borrow more despite pressure to stimulate growth, fueling expectations Beijing may pick up their slack and take on more debt.

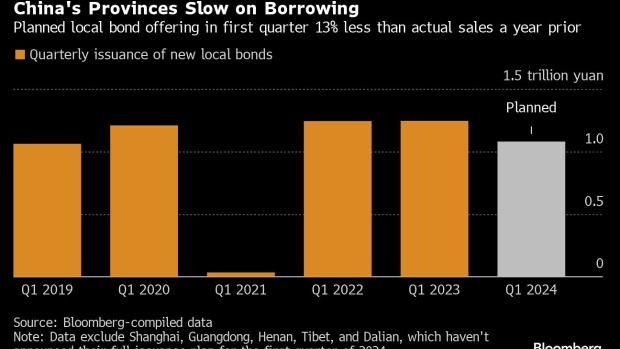

Regional authorities nationwide plan to issue new bonds totaling 1.08 trillion yuan ($150 billion) for the first quarter, about 13% less than they sold over the same period last year and the lowest since 2021, Bloomberg-compiled data showed. That tally doesn’t include several local governments that hadn’t disclosed their plans by Friday, including Shanghai, Guangdong and Dalian.

Actual offerings have fallen even more, with new bonds sold by all local governments in the first eight weeks slumping 56% compared to 2023.

“The slower planned issuance of local bonds suggests it’s only more likely that the central government will add more leverage this year to fill in the investment gap,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc.

The slowing local bond supply could put pressure on Beijing to take over more borrowing responsibility from provinces after it took the unusual step in October to sell additional sovereign notes with all the proceeds being transferred for local use.

This helps curb local debt risks, but the shift in fiscal power gives local governments less reason to raise funds on their own, and it could reduce their drive to make new policies. Local authorities are typically encouraged to sell bonds early in the year and spend the funds on infrastructure and other projects.

Chinese top leaders in December vowed to “appropriately strengthen the proactive fiscal policy,” raising expectations for more government spending. They’re set to reveal specific measures and the size of budget deficit at next month’s annual session of the National People’s Congress.

Local Debt Constraints

Beijing has sought to diffuse a $9.3 trillion time bomb in hidden local debt by restricting indebted, poorer regions from making new borrowing. These local authorities have instead focused on reducing existing credit risks by using bond quota saved from previous years to swap off-balance-sheet liabilities into government notes.

Domestic media reported last month that the central government has ordered 12 high-risk regions to strictly limit new projects and suspend some that are already in construction. These provincial-level governments include Tianjin, Inner Mongolia, Guizhou and Yunnan.

Wealthier areas are under pressure to ramp up infrastructure investment, but they have struggled to find productive projects and some have reduced their bond stockpile to save costs. Last year, Beijing became the first provincial-level government to repay special local bonds ahead of schedule, saving more than 70% of the interest payment on the notes.

Local governments may also have funds left over from last year to tap, further reducing the need for issuing more bonds just yet. Standard Chartered’s Ding estimates they have a combined 900 billion yuan in unused proceeds from last year’s local bond sales.

That said, the local debt supply could pick up in the rest of the year after the NPC publishes the annual quota next month. Local governments can sell bonds ahead of the March meeting using 2.28 trillion yuan of front-loaded special local bond quota.

More projects are also being added into the pipeline. Some regions are looking to use cash raised from special bond sales as equity capital in affordable housing projects, expanding the use of the notes, the 21st Century Business Herald reported this month.

Central Borrowing Expected

Some economists expect the government to announce an expansion of its broad deficit at the NPC session next month, but this may not directly translate to increased spending.

“The key is implementation, though, given that the budget was under-implemented in the past few years,” Ding said.

As a strong dollar limits how much China can ease its monetary policy without causing more capital flight, fiscal policy has emerged as a key tool Beijing has to stimulate growth amid a historic property slump and stubborn deflation.

After raising 1 trillion yuan from sovereign bonds announced in October for disaster relief and related investments, policymakers are considering another 1 trillion yuan of new issuance to fund projects related to food, energy, supply chains and urbanization, Bloomberg News has reported.

“The central government is quite determined to defuse local government debt risks,” said Jing Wang, an economist with Nomura International Hong Kong. But there is a “decent chance” for the central government to issue more bonds and increase transfers to regional governments to address economic woes and local fiscal challenge, he said.

--With assistance from Jing Zhao.

©2024 Bloomberg L.P.