Canada’s national housing agency plans to revamp its forecasts to call for a drop of as much as 15 per cent in home prices, as higher mortgage rates threaten to cause a protracted slump in real estate.

Canada Mortgage & Housing Corp. said in July that national housing prices could slide 5 per cent by mid-2023, compared with levels earlier this year. It’s now revising those projections to allow for a 10 per cent to 15 per cent decline, Chief Executive Officer Romy Bowers said in an interview Thursday at the Bloomberg Canadian Finance Conference.

“We’ve seen that inflation has been more persistent than we originally anticipated and the Bank of Canada is taking more aggressive action, so we’re in the process of revising our forecasts,” Bowers said, adding that the new projections would be released soon.

Since CMHC’s July forecast, the central bank has stepped up what was already one of the most aggressive rate-hiking cycles in its history. It shocked markets by increasing the policy rate a full percentage point on July 13 -- the biggest since 1998 -- then raised the rate again by three-quarters of a point in September.

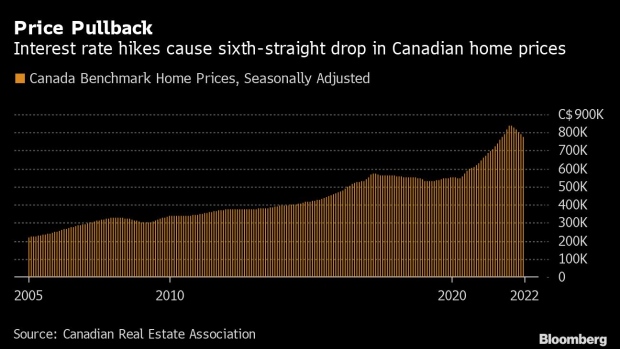

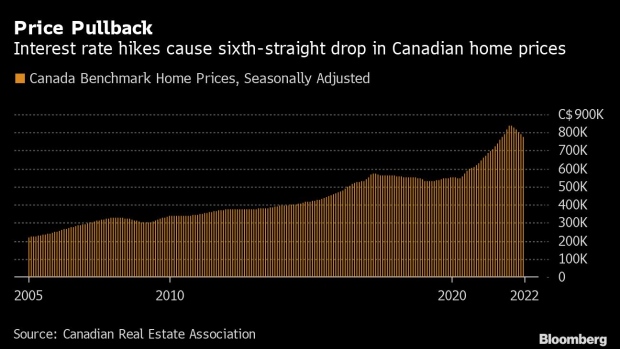

Variable-rate mortgages at Royal Bank of Canada, which were offered at less than 2 per cent in February, are now over 5 per cent and poised to go even higher if the central bank lifts rates in October, as expected. The abrupt rise in borrowing costs has had an immediate impact, prompting benchmark home prices to fall for six straight months.

CMHC’s new projections would bring its forecasts closer to those of private sector economists. Still, Bowers said price declines must be viewed against the historic gains in home values over the last two years.

“It’s very important when thinking about this price decrease to think about the rapid, sort of unsustainable, levels of house price increases that occurred during the pandemic,” she said, adding that shelter will remain unaffordable for many Canadians.

In fact, even though prices have dipped since February, it has never been harder for Canadians to buy a home, according to a new report by RBC economists. Total ownership costs, including mortgage payments, now soak up 60 per cent of a typical household’s income, higher than the previous record of 57 per cent.