Oct 18, 2023

Codelco Makes First Lithium Acquisition With Australian Deal

, Bloomberg News

(Bloomberg) -- Codelco, the world’s biggest copper producer, agreed to acquire Lithium Power International Ltd. as the Chilean company boosts its position in the key material for electric-vehicle batteries.

The buyout, which needs approval from Lithium Power shareholders, values the Sydney-listed firm at A$385 million ($245 million). It would be Codelco’s first lithium acquisition as the state-owned firm targets the Australian company’s project in the Maricunga salt flat of northern Chile.

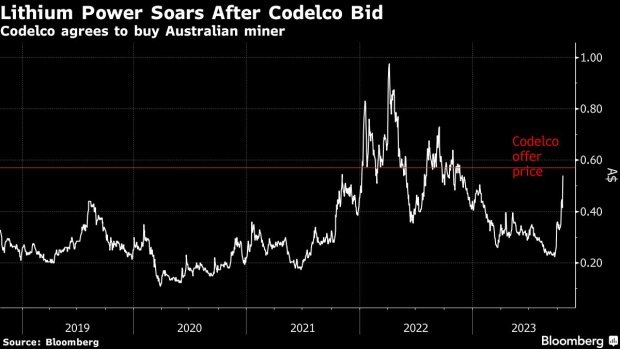

Lithium Power shares rose as much as 30% on Wednesday.

Codelco has been tapped to represent the Chilean state in a new public-private model for lithium as President Gabriel Boric looks to open up new areas for production to meet growing demand from the EV boom. Chile is the second-biggest lithium supplier after Australia but has lost market share with output restricted to two companies on a single flat.

The global lithium industry has seen a wave of acquisitions in recent years as companies, investors and governments seek a grip on future supplies. Prices for the battery material have retreated this year as concerns over an immediate shortage ease, but they’re still at elevated levels.

Read More: Codelco Says It Hit Rock Bottom. Investors Need More Convincing

The acquisition would simplify Codelco’s efforts to develop lithium mining in Maricunga given Lithium Power’s project there already has permitting. Still, Codelco’s move into lithium M&A may also fan criticism for presenting a distraction from copper. The company has been struggling with mine mishaps and project delays that have eroded production and pushed up debt, spurring Moody’s Investors Service to cut its credit rating.

“It leaves me with mixed feelings,” said Juan Carlos Guajardo, head of consulting firm Plusmining. “On the one hand, it seems to deepen Codelco’s distraction from its main business, which is copper, where the situation is very complex. But on the other hand, the viability of the development of the Maricunga salt flat increases.”

Read More: Lithium Power Confirms in Talks With Codelco on Potential Deal

Lithium Power shareholders will receive A$0.57 in cash per share, a premium of 119% to the “undisturbed” closing share price on Sept. 26, according to a statement to the Australian Securities Exchange.

Its board unanimously recommends shareholders vote in favor of the deal, in the absence of a superior proposal and subject to the independent expert concluding it’s in the best interests of its shareholders. The company’s major shareholder, Minera Salar Blanco SpA, intends to vote its 28.25% stake in favor of the deal, in the absence of a superior proposal.

Lithium Power has projects in Chile and Australia, according to its website. Its Maricunga project, located within the so-called lithium triangle in northern Chile, is estimated to contain about 1.9 million tons of lithium carbonate equivalent. The firm’s projects in Western Australia are still in exploration stage.

--With assistance from Martin Ritchie.

(Adds background in third and fourth paragraphs.)

©2023 Bloomberg L.P.