Feb 26, 2024

Copper Falls as Inventories Surge in China After Lunar New Year

, Bloomberg News

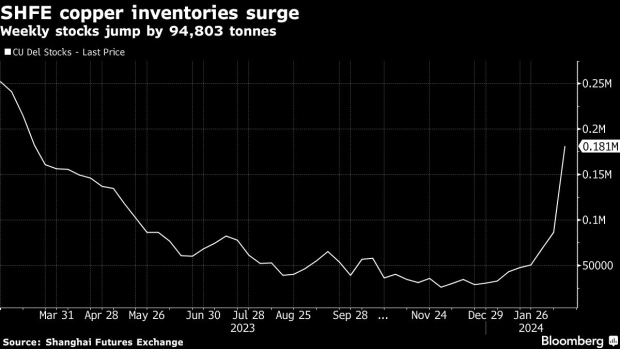

(Bloomberg) -- Copper fell along with most industrial metals, as rising inventories in China pointed to signs that a significant pick-up in demand following the Lunar New Year holiday is yet to materialize.

Weekly inventories for all base metals increased over the past week, with copper spiking in warehouses monitored by Shanghai Futures Exchange, after consumption slowed during the week-long holiday earlier this month. Meanwhile, London Metal Exchange copper stockpiles rose the most since November.

In another sign of a slow recovery in demand, local refined copper has been trading at a discount to the futures benchmark.

Weakening demand for copper is translating into rising inventories, and an uncertain outlook for China’s property sector will likely continue to put downward pressure on the market, said Ewa Manthey, a commodity strategist at ING Groep. Commodity-intensive stimulus will be needed to support short to medium-term demand growth, she said.

Investors are now waiting for the Chinese government to roll out more stimulus after President Xi Jinping on Friday called for a boost in sales of traditional consumer products, including cars and home appliances. Expectations of more economic aid have also been fueled by weak borrowing by local governments, stirring speculation Beijing may pick up their slack and take on more debt.

Weakness in industrial metals was also driven by the omission of major curbs on Russian industrial metals in Friday’s US sanctions package, Saxo Bank A/S commodity strategist Ole Hansen said.

Copper fell 1.3% to $8,455.50 a ton on the London Metal Exchange as of 4:30 p.m. in London. Nickel declined 1.9% to $17,155.00 a ton after surging 7% last week, in its biggest weekly gain in seven months. Aluminum was little changed.

©2024 Bloomberg L.P.