Jul 5, 2022

Copper spirals to 19-month low as recession fears dominate

, Bloomberg News

We were seeing extreme price highs for canola but that has corrected: Commodity analyst

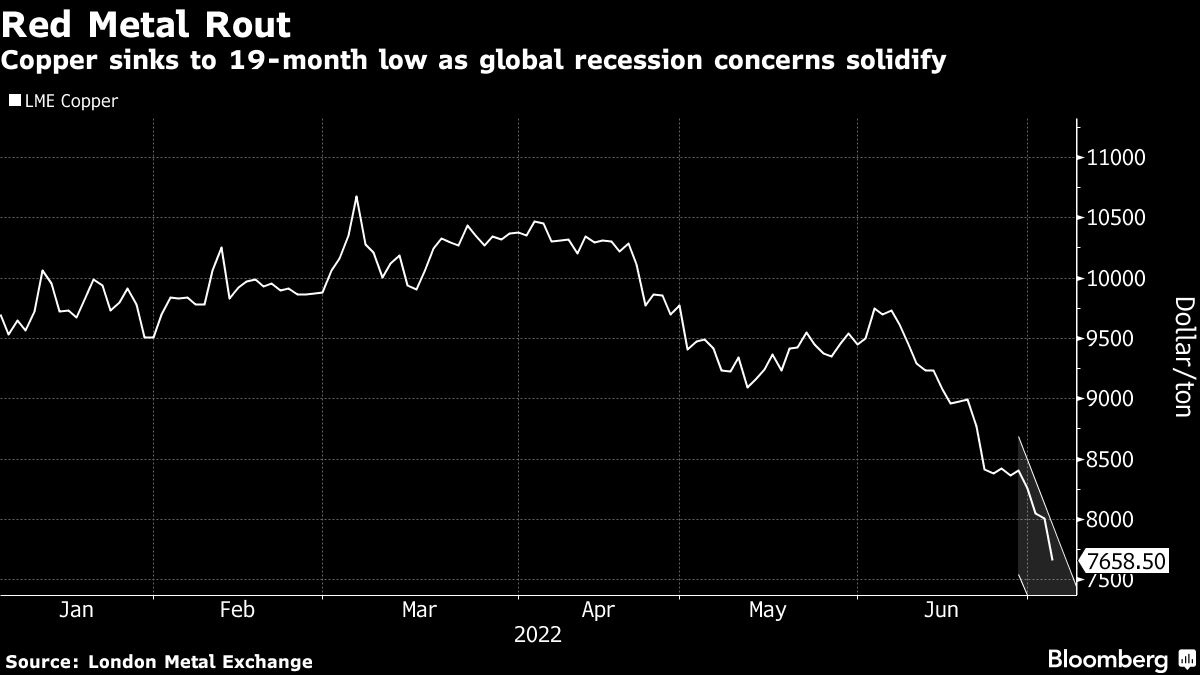

Copper fell to its lowest price in 19 months, with metals extending losses as global recession fears continue to damp the demand outlook for commodities.

Sentiment remains sour for industrial materials used in everything from construction to new energy vehicles. Copper, widely considered an economic bellwether, is trading well below US$8,000 a ton after metals posted their worst quarterly slump since the 2008 financial crisis.

“Sentiment in US industry is becoming more gloomy, in other words; we interpret this as a sign that the US economy is losing momentum,” Commerzbank AG analyst Carsten Fritsch said in a report. “Concerns about a global recession continue to predominate on the metals markets.”

The chances of a US recession are now 38 per cent, according to the latest forecasts from Bloomberg Economics.

Metal prices likely will drop in the medium to longer term, though a technical correction higher is possible in the near term, Citic Futures Co. said in a note.

For zinc, which is used to galvanize steel, prices also risk a further pullback, with top producer China set to ship its domestic surplus to western countries to fill the shortfall that’s emerged in the wake of Russia’s invasion of Ukraine. Deteriorating demand and China’s shift to becoming a net exporter is expected to alleviate tightness in the metal, according to UBS AG.

Copper fell as much as 5.1 per cent to US$7,597 a ton on the London Metal Exchange, its lowest since early December 2020. It settled at US$7,670 a ton at 7:30 p.m. local time. Other metals followed suit, with aluminum dropping 2.9 per cent and tin falling 2.3 per cent. Nickel, the only metal on the exchange to see green today, rose 0.7 per cent.

Precious metals continued the trend in the red, with gold down 2.2 per cent in the face of a stronger dollar. Silver sank 3.7 per cent while platinum dropped 2.5 per cent.