Mar 16, 2023

Credit Suisse Bonds Sink Deeper Into Distress as Hopes Fade

, Bloomberg News

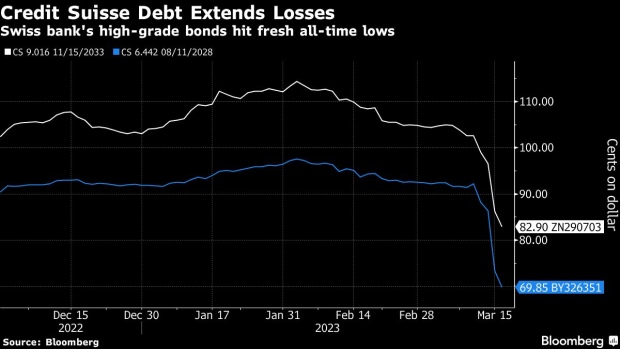

(Bloomberg) -- The crisis enveloping Credit Suisse Group AG showed few signs of easing Thursday as its bonds fell deeper into distress and the cost to insure the debt against default continued to climb. Early gains prompted by the lender saying it would tap Switzerland’s central bank for fresh funds were erased.

Support from the Swiss National Bank, which offered as much as 50 billion francs ($54 billion) from its liquidity facility, had brought some temporary relief to Credit Suisse and risk gauges for the broader European banking sector. That fizzled amid comments from the European Central Bank that some of the region’s lenders could be vulnerable to monetary policy tightening, followed by its decision to proceed with a planned half-point increase in interest rates.

The continued selloff signals more action may be needed to arrest a collapse in confidence that’s prompted clients to step back from the Swiss lender and banks to shield their finances from the potential fallout. While the panic surrounding Credit Suisse has so far shown little sign of infecting the broader financial system, any further turmoil would pose a significant risk for markets already on edge amid soaring interest rates and rampant inflation.

“People will be questioning how well the bank is actually being run, particularly in the aftermath of the various scandals it’s been involved in recently,” said Joanna Ford, a restructuring partner at Cripps. Investors “will still be very concerned by the fact that it needed to borrow the money in the first place,” she said, referring to its funding lifeline from the SNB.

The bank’s stock, which surged as much as 40% on Thursday, pared gains to about 19% in late Zurich trading.

Credit Suisse didn’t immediately reply to a request for comment.

The lenders’s dollar bonds were again the worst performers in credit markets globally Thursday, trading at levels suggesting significant doubt in the bank’s long-term outlook. Traders indicated one-year credit-default swaps at 19 to 25 points upfront, up from 10.5 to 17.5, according to people who saw the quotes.

They were indicated between 20 and 30 points on Wednesday afternoon. Wide bid-ask spreads tend to emerge in illiquid or risky names, where it’s hard to match buyers and sellers of credit protection.

The last recorded quote on pricing source CMAQ was about 3,409 basis points at 4:27 p.m. London time, after falling below 2,500 basis points in the morning. Spreads over 1,000 basis points in one-year senior bank CDS are extremely rare and regarded as a sign of distress. Major Greek banks traded at similar levels during the country’s debt crisis.

The lender’s 4.55% dollar-denominated bond due 2026 plunged by 15.5 cents to 63 cents, trading at spreads of about 1,800 basis points — a level associated with distress. Meanwhile, senior unsecured euro-denominated bonds due March 2029 reversed earlier gains, dropping about 2 cents on the euro to trade at 69 cents, according to data compiled by Bloomberg. The declines follow record losses in the debt on Wednesday.

JPMorgan Chase & Co. analysts said that the Swiss lender’s troubles are most likely to end in a takeover, with the most probable scenario being an acquisition by UBS Group AG. Credit Suisse’s capital position isn’t an issue, but the “situation is about ongoing market confidence issues with its IB strategy and ongoing franchise erosion,” analysts led by Kian Abouhossein wrote in a note. “Status quo is no longer an option.”

--With assistance from Luca Casiraghi.

©2023 Bloomberg L.P.