Nov 11, 2022

Crypto Markets Buckle as FTX Bankruptcy Spurs Search for Casualties

, Bloomberg News

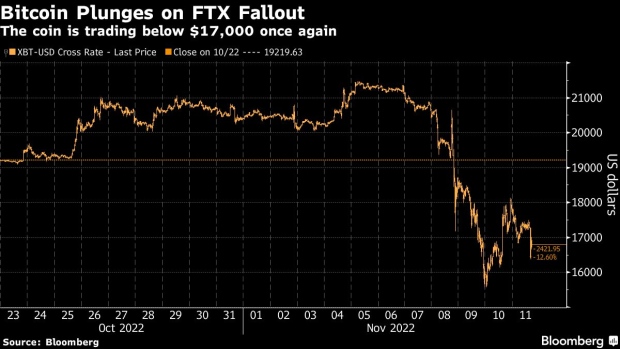

(Bloomberg) -- The bankruptcy of FTX.com sent crypto markets reeling to two-year lows with investors braced for details on collateral damage from the failure of an institution whose influence pervaded the industry.

Bitcoin, the largest coin by market value, fell more than 8% at one point Friday to trade at $16,375. It dropped to around $15,500 earlier in the week. Other cryptocurrencies also plunged, and FTX’s token FTT suffered a 50% slide at its worst. The filing raised the prospect that billions of dollars in customer deposits will be subject to a drawn-out courtroom battle of uncertain resolution.

Losses for shares for cryptocurrency-exposed companies also deepened, with Riot Blockchain Inc. down 3%, MicroStrategy Inc. off by 3% and Marathon Digital Holdings Inc. lower by about 6% around noon in New York.

“It’s going to put a major, major dent in investor trust,” said Emily Roland, co-chief investment strategist for John Hancock Investment Management, in an interview with Bloomberg TV. “We are probably going to see more writedowns here. It’s a really, really challenging backdrop.”

The failure of Sam Bankman-Fried’s crypto empire -- a week ago arguably the industry’s highest-profile and best-respected company -- is shaking the foundations of the cryptosphere. Urgent questions include which firms are exposed to FTX and its sibling company Alameda Trading, either through loans, investments, deposits or other entanglements.

FTX’s Chapter 11 filing said that approximately 130 affiliated companies have commenced voluntary proceedings. But the crisis has ensnared many others outside its immediate circle such as lender BlockFi, a troubled digital-asset lender once worth $3 billion but which has now limited activity on its platform. The company paused client withdrawals late Thursday, citing “a lack of clarity” over the status of FTX US as well as the uncertainty afflicting FTX.com and sister trading house Alameda Research.

“I don’t think it’s over yet. Clearly this overhang from crypto is not constructive,” Morgan Stanley’s Mike Wilson said on Bloomberg TV on Friday.

FTX and its subsidiaries had for a while been thought of as the cream of the crop in crypto. Retail investors and institutions alike used the platform. It had been Bankman-Fried, after all, who had stepped in to help over the summer when others were imploding. Before all this, he had been compared to John Pierpont Morgan. He hung out with Tom Brady and Gisele Bündchen. His company ran ads during the Super Bowl and had bought naming rights to the arena where the Miami Heat basketball team plays. But now, faith in him has crumbled, with a whole industry now demanding answers to what happened.

“You’re seeing this wealth destruction,” said Peter Tchir, head of macro strategy at Academy Securities. “It’s affecting all the direct investors and, two, it’s really affecting people who are involved in the space completely. You really do have to call into question where you’re holding your money, how transparent they are, where they’re domiciled.”

Trading firm Genesis is getting a $140 million equity infusion from its parent company Digital Currency Group, after it disclosed its derivatives business has $175 million in funds locked in a FTX trading account. And Anthony Scaramucci said his firm SkyBridge Capital is trying to repurchase the 30% of his company that FTX acquired months before the crypto exchange imploded.

Meanwhile, Sequoia Capital wrote down the full value of its $214 million investment in FTX, and debacle has also ensnared some of the biggest names in finance. Tiger Global Management, Third Point and Altimeter Capital Management are among hedge funds that recently participated in funding rounds for the once-high-flying crypto exchange.

The full extent of the fallout will take weeks, if not months, to unfold. Hordes of retail investors who had money on the platform have also been affected. FTX had its assets frozen in the Bahamas, where the crypto exchange is based. The bankruptcy filing, at the very least, means that its creditors will soon be revealed.

“The collapse and bankruptcy of FTX is a watershed moment for the crypto industry,” said Craig Johnson, chief market technician at Piper Sandler. “The failure of FTX will led to more rules and regulations around the world. These new rules will ultimately be a positive catalyst for Crypto adoption and bring some badly needed adult supervision to the industry.”

--With assistance from Isabelle Lee and Hannah Miller.

©2022 Bloomberg L.P.