Apr 28, 2023

Deutsche Bank Emulates JPMorgan in First Big Deal Under Sewing

, Bloomberg News

(Bloomberg) -- Deutsche Bank AG spent a decade shedding jobs, settling legacy litigation and undoing acquisitions that had gone awry after the financial crisis.

In his first major deal as chief executive officer, Christian Sewing is trying to avoid the mistakes of the past and emulate investment banking titan JPMorgan Chase & Co. in a bet that a major London presence is still key to dominating financial markets.

Sewing on Friday agreed to buy Numis Corp., one of the best-known UK boutiques, in a surprising change of pace for a CEO who has refocused Deutsche Bank on its existing strengths in corporate banking and fixed income trading. Valued at £410 million ($511 million), the deal is the firm’s largest since the 2009 purchase of retail lender Postbank and will take it from a few dozen bankers focused on UK offerings to one of the biggest teams in the City.

Deutsche Bank’s executives view the transaction as akin to JPMorgan’s tie-up with UK brokerage Cazenove & Co., widely seen as a success now that the US bank is the top IPO underwriter and second-ranked merger adviser on UK deals in the last five years.

Numis is the No. 1 UK corporate broker by number of clients, ahead of Peel Hunt Ltd. and JPMorgan Cazenove, according to data provider ARL, giving Deutsche Bank the opportunity to cross-sell advisory and financial products to those clients.

Corporate broking is a role unique to the UK financial landscape, where banks provide advice to companies on markets and the performance of their stock, sometimes seen as a glorified investor relations function. Banks often parlay the low-paying relationships into more lucrative deal mandates or to provide other equity or debt-related products.

“Numis has created a very good position in London,” said Tim Linacre, a former CEO of stockbroker Panmure Gordon who is now deputy chairman of public relations firm Instinctif Partners. “With Deutsche’s Mittelstand focus, the two fit together well.”

A slump in dealmaking — and Numis’s resulting 46% stock slide over the past two years — allowed Deutsche Bank to pick up the boutique at an opportune time. The lender views its investment as counter-cyclical, demonstrating a belief that the advisory and underwriting businesses will come back, the people said. It’s also a vote of confidence in the UK’s economy and the City’s ability to remain a hub for public listings, they said.

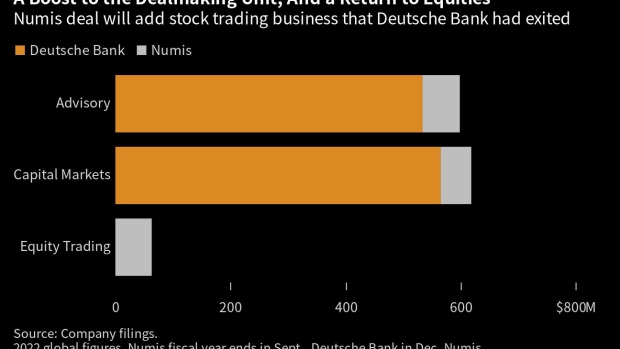

But some analysts expressed skepticism, with JPMorgan’s Kian Abouhossein saying he was “surprised” the lender would buy an equity trading franchise after shuttering the business four years ago.

Sewing took over in 2018 with a mandate to radically scale back the investment bank after years of smaller and unsuccessful cutbacks by his predecessors. The centerpiece of his restructuring plan, presented a year later, was an exit from equities and cutbacks to other parts of the securities business.

The decision effectively ended a 30-year effort to become a global trading powerhouse that had started when Deutsche Bank took over London-based investment bank Morgan Grenfell. The deal, and the subsequent acquisition of U.S.-based Bankers Trust a decade later, briefly turned the German lender into the world’s biggest financial services company.

A Deutsche Bank lifer, Sewing vowed to return the lender to its roots providing banking services to large international businesses. In reality, however, the CEO was quick to adapt when market conditions changed. While he proceeded to sell the equities franchise, he quickly reversed other cuts to the securities unit, turning the fixed-income business into the main revenue driver.

More recently, Deutsche Bank revisited other businesses it previously cut back, as its seeks to offset a slowdown in the trading boom of the past years. It has added high-yield credit default swaps and is dipping its toes into base metals trading after exiting commodities almost entirely in 2013. Trading head Ram Nayak also floated a return to trading residential mortgage-based securities, Bloomberg reported last year.

The bank has since managed to restore profitability close to levels seen at rivals and, for the first time in a decade, is generating enough income to return some money to shareholders — or spend it on substantial acquisitions.

The Numis deal will add a small team of equities traders again, but the lender pushed back against a perception that it was a change in strategy. Chief Financial Officer James von Moltke told analysts Friday it shouldn’t be seen as a return to equities trading. Numis only does “agency brokerage” for corporations, complementing a business that Deutsche Bank still has. The deal also won’t derail plans for a share buyback, he suggested.

The purchase will beef up Deutsche Bank’s deal advisory and capital underwriting, an area Sewing had earmarked for growth. Deutsche Bank has been hiring several senior executives from Credit Suisse Group AG as part of the effort, taking advantage of the woes at the Swiss rival, which last month collapsed into the arms of UBS Group AG.

Stock and bond sales as well as dealmaking have slumped in recent quarters amid rising interest rates and the war in Ukraine. At Deutsche Bank, first-quarter revenue from that business was down by 31% from a year ago, although it jumped by two-thirds from the previous quarter. The unit is just over a tenth the size of the fixed-income trading business.

The deal could also be an early call on reforms the UK government is working on that are claimed to be benefits of Brexit. The government is seeking to to stir investors’ interest in the medium-sized firms Numis represents firms by unraveling European Union restrictions on how analyst research is paid for.

Deutsche Bank shares rose Friday, during a day in which most financial stocks suffered steep declines, suggesting investors view the purchase positively.

The German lender said it intends to co-brand with Numis. But Instictif Parner’s Linacre said it’s not clear whether Deutsche Bank’s main rationale for the deal — to cross-sell products to Numis’s corporate clients — will pan out.

“Brokers always worry that they will be the double-glazing salesmen and there must be a risk that this will happen here,” Linacre said.

©2023 Bloomberg L.P.