May 2, 2024

Outside London, UK Finance Startups Battle for Scarce Funding

, Bloomberg News

(Bloomberg) -- Laura Pomfret and Holly Holland took their finance startup on the road over the winter, traveling from Manchester to Helsinki to rub shoulders with potential backers. In some ways, it was easier than trying to raise money in Britain.

Pomfret and her team of three soaked up keynote speeches, bonded over cold plunges and networked with other founders at Christmas markets. International investors, though, were their main target. “There’s a lot of people in the North trying to do more,” said Pomfret. “But the UK investment landscape is incredibly London-centric.”

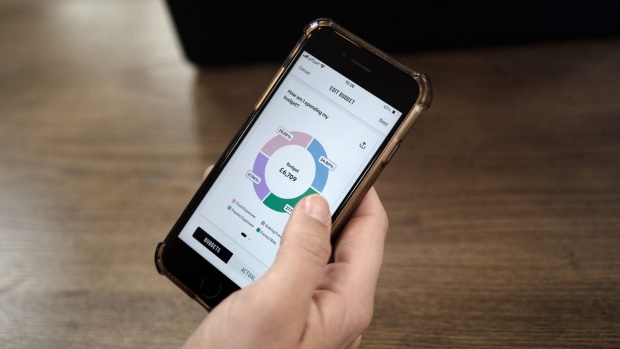

In Manchester – the birthplace of the industrial revolution and modern computing – Pomfret and Holland built the Financielle app with their own money in the beginning, before finding mostly local investors. They’re among a small but growing scene: the number of fintech startups and scaleups in Greater Manchester tripled to 124 over three years, according to consultancy Whitecap in 2023, making it one of the fastest growing tech hubs in Europe.

Yet entrepreneurs in Manchester, and the north more broadly, say they are struggling to get attention from funders and policymakers, who are mostly in London. After more than a decade of government attempts to tip the balance via Levelling Up and Northern Powerhouse policies, the established ecosystem that built a fintech boom in the capital — supporting the city’s position as the engine room of the entire UK economy — has proved difficult to disrupt.

If northern startups received as much as their London counterparts in venture funding, they would get nearly £10 billion more a year, according to estimates by early-stage venture capital firm Praetura Ventures.

Building Momentum

Pomfret and Holland’s hobby sharing money saving tips with women took off on Instagram during the pandemic. As their community grew, they left corporate jobs to focus on launching their app from a converted warehouse in Manchester.

As expenses mounted – train tickets, hotel stays and childcare – Pomfret, 36, and Holland, 34, couldn’t keep traveling to London for meetings with venture capitalists that could be canceled at the last minute. They put in their own funds – raised by, among other things, selling a Chanel handbag – and revenue from sponsored social media posts. Financielle now has more than 200,000 downloads and the sisters have almost completed a £1 million fundraise to help them expand further.

Despite the rise of virtual meetings since Covid-19, putting in real face-time with potential investors is still seen as the key to building momentum. “If you can get in front of these people, if you can impress them, not just in a pitch scenario but kind of on a more regular basis, then you don’t need 200, you need 10 more people that are already really interested in what you’re doing,” Pomfret said. “It’s a higher numbers game.”

Some investors share their preference for building relationships locally. Among Financielle’s backers is Bankifi chief executive officer Mark Hartley, a Manchester native, who moved back to his hometown to establish a company after working abroad in software for financial institutions. For him, investing locally is a matter of the heart. “Stop trying to say, we can compete with London, we can’t compete with London,” he said. “What we need to do is fit in and find our niche and find what we can make successful.”

Hartley wants his business brand “to have all the good things about Manchester – hard work, salt of the earth, say it how it is — but I don’t expect all my employees and I certainly don’t expect all my customers to be there.”

Productivity Gap

A succession of strikes and operational problems on the railways serving the north in recent years have made the 180-mile distance between the capital and Manchester seem even further. HS2 — a new line to improve capacity between London, several cities in the north and eventually Scotland — was drastically scaled back in October and is now set to stop at Birmingham.

The amputation of HS2 has been highlighted by the opposition Labour Party as an emblem of the UK’s imbalance. Productivity in the north is £7 per hour below the England average, one of the starkest regional disparities in the OECD group of wealthy nations, according to a report last year by the Institute for Public Policy Research, a progressive think-tank.

Manchester’s Labour mayor, Andy Burnham, is trying to bring more power back into the city’s hands with measures such as local control of bus services. “We’ve closed the productivity gap with London, not completely, but we’re closing it more so than any other city outside of London. We’ve been growing faster than the UK economy,” he said in an interview.

“I just think too many in Whitehall are stuck in their old ways that to spend, to invest, in the north is like doing us a favour,” said Burnham.

For the startup scene, the north’s reputation as London’s distant cousin endures. Many of those interviewed for this story pointed to the role of investors in this dynamic.

“As seed stage investors we know great companies can come from anywhere but what excites us is when there is a growing ecosystem in a city,” said Tom Lambert, a partner at the LocalGlobe venture capital firm, based in London.He added there needed to be more incentives like demo days and startup hubs to attract investors to the regions. LocalGlobe, for its part, has invested in Concretene, a company that was spun out of Manchester University’s Nobel Prize-winning research on graphene and aims to reduce emissions in the built environment. Its sister fund Latitude has invested in European savings fintech Raisin, whose UK business is based in Manchester.

Lambert said it can take just one industry-leading company in a city to spark others. He pointed to Tallinn in Estonia, hometown of the founders of payments company Wise Plc. “It is about a tipping point and in the last three years Manchester has been attracting more VC. That will only continue,” he said.

Untapped Candidates

The relative shortage of startups in the north belies the number of more established finance firms with a presence there — even if many have kept their headquarters elsewhere.

Revolut, one of Britain’s biggest fintech startups, has about a third of its British workforce based outside London as part of its remote-first working practice. “Revolut UK is able to access a wider talent pool by hiring from across the country,” the firm said in a statement.

Starling Bank and Kroo have added staff among the glass towers of Manchester’s financial district over the past year, while Dutch payment giant Adyen and Sweden’s Klarna, the buy-now-pay-later provider, also have offices. Banking giants such as Lloyds Banking Group Plc and Bank of New York Mellon Corp. have long had offshoots in the city.

“We just thought coming to Manchester, we’ve got a wealth of candidates, untapped markets that we can really attract,” said Phill Gleave, Kroo’s head of central operations. Still, Kroo’s team of about 50 here is a fraction of the number working at the head office in London.

A hundreds miles up through the hills of the Pennines is Durham’s Aykley Heads area, where Atom Bank was born in 2014 and now employs more than 500 people. Mark Mullen, chief executive officer, is looking for new offices for the bank’s growing headcount, but said the digital bank will remain in the region as a matter of “social agenda.”

With one eye on creating job opportunities in the region, Atom has partnered with neighboring Durham University to fund scholarships aimed at prospective women students from low-income backgrounds at the Department of Computer Science.

Public Partnerships

The UK government has its own ideas for growing the fintech sector outside London. The Centre for Finance, Innovation, and Technology was set up early last year in Leeds with £5.5 million from the Treasury and the City of London.

CFIT’s chair is Charlotte Crosswell, the former CEO of industry body Innovate Finance, who thinks one way to stoke the north’s startup scene is through collaboration between universities and industry. “If we can tap into their creative and entrepreneurial mindset, who knows what could be achieved,” Crosswell said.

One example of this is the Alliance Manchester Business School offering a fintech master’s program that should feed the city’s startup pipeline and tap into data science expertise from the Alan Turing Institute — whose namesake worked at the university. The entrepreneurship center fosters around 35 new startups annually, with a “really good survival rate,” said Professor Ken McPhail, the new head of the business school.

Joe Roche of Fintech North, an industry hub based in Leeds, said that while “the days of blank checks from investors are kind of over,” the region could see more funding opportunities as London is “overheated.” He is hopeful that the trend of graduates moving from northern universities to London for a tech career would slow, given the jobs starting to emerge “on their doorstep.”

©2024 Bloomberg L.P.