Nov 23, 2020

Dollar Rises From Lowest Since 2018 as U.S. Data Eclipse Vaccine

, Bloomberg News

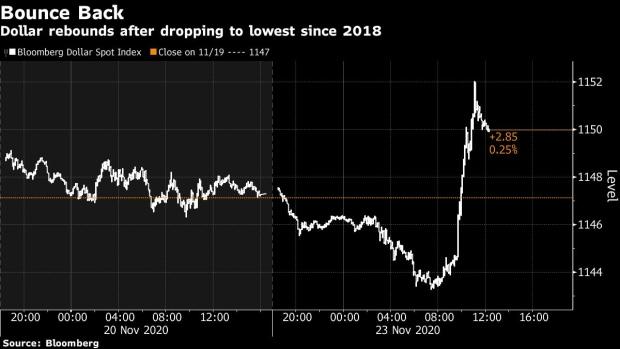

(Bloomberg) -- The dollar advanced after dropping Monday to a two-and-a-half year low as economic data signaled the U.S. was recovering at a faster pace than Europe, overshadowing optimism about vaccine roll-outs.

The Bloomberg Dollar Spot Index rose 0.2% and strengthened against most Group-of-10 currency peers as a report showed U.S. business activity expanded at the fastest pace since 2015. The yen weakened the most, while the pound led gains among G-10 counterparts. The yield on 10-year U.S. Treasuries rose almost three basis points to 0.85%.

The greenback is starting off the week on a positive footing after posting a weekly loss. Wall Street strategists are generally bearish on its outlook, with one investment bank calling for a drop of as much as 20% next year. TD Securities said the broader markets are too optimistic amid the vaccine news, and that helped to drive the dollar down earlier.

Markets are “in major cognitive-dissonance mode right now -- ignore all bad facts and trade on the good ones,” said Mark McCormick, strategist at TD. “Current realities related to Covid, mobility and growth don’t dovetail with market pricing.”

McCormick expects the dollar to strengthen into year-end.

The greenback’s rebound in New York morning trading came as the IHS Markit flash composite index of purchasing managers at manufacturers and service providers increased to 57.9 from 56.3, signaling momentum in the U.S. economy. Investors are comparing the U.S. data with fledgling European data and that’s helping to support the greenback, said Alan Ruskin, chief international strategist at Deutsche Bank AG.

On top of that, a series of stops were triggered in the dollar-yen pair, beginning above 103.80, according to traders, as Japan’s Covid cases also hover around record levels. That’s helped to drive the pair up 0.5% to 104.34 at 12:55 p.m. in New York.

Earlier, demand for the greenback sagged as U.S. officials said that vaccinations may start in less than three weeks. The outlook for the currency remains grim as an inoculation that offers adequate protection against infection could help power a rebound in global growth and add momentum to a rally in equities and other riskier investments. In addition, Federal Reserve policy remains dovish and U.S. real yields are in negative territory this year after nominal rates fell. Those factors have been undermining the greenback, which is down about 11% from its March highs.

At least for today, the greenback is showing its resilience.

©2020 Bloomberg L.P.