Nov 17, 2023

Dollar’s Worst Week in Months Erases 2023 Gains on Rate Cut Bets

, Bloomberg News

(Bloomberg) -- Traders speculating that the Federal Reserve is finally done with interest rate increases have put the US dollar on the defensive once again.

A Bloomberg gauge of the greenback retreated on Friday, extending its weekly drop to 1.5% — the biggest such slump since mid-July — and erasing its 2023 gains. A weaker dollar also bolstered this year’s worst performing Group-of-10 currency, the yen.

The dollar gauge is now on course for its biggest monthly drop in a year after softer-than-expected economic data reinforced expectations that the Fed is done with its hiking cycle and the US currency — which benefited from the highest benchmark rates in decades — may have already peaked. The data came as traders parsed a flurry of speeches from US central bank officials for dovish comments and traders penciled in rate cuts for mid-2024.

Similarly, the ICE dollar index fell 1.6% over the past week, trimming its year-to-date advance to approximately 0.6% and is on track for its worst monthly drop of the past 12. Meanwhile, the yen surged as much as 1% on Friday to advance to 149.20 per dollar, the strongest in two weeks.

“The dollar remains vulnerable until we see a shift in market sentiment and expectations,” Win Thin, global head of currency strategy at Brown Brothers Harriman & Co. wrote in a Friday morning email to clients. While Thin says markets are overestimating how soon and by how much the Fed will cut rates, “it will take some firm real sector data to challenge the current dovish Fed narrative.”

The pushback may even come from the Fed itself “in the near-term,” according to Jane Foley, head of FX strategy at Rabobank in London. The US central bank is likely to disagree with “the amount of rate cuts that have been priced in,” she added.

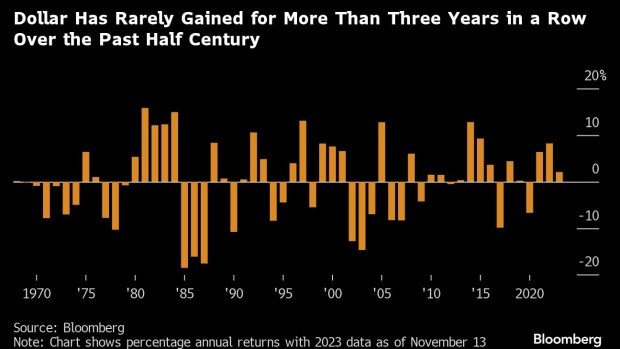

That leaves the door open for a US dollar rebound in the coming weeks, the currency could still finish 2023 higher and extend its annual gains that started in 2021. History, however, suggests any dollar strength rarely extends beyond three years in a row.

For the ICE dollar index, data going back to 1967 show there were only two occasions when consecutive annual gains went beyond three: the first was 1980-84 when Volcker-era rate hikes led to a record five-year-in-a-row rally. The next came in 2013, when Fed tapering and the first rate increase since the Global Financial Crisis helped deliver four straight annual advances.

“Once Fed rates do fall, that should be good for risky assets and should weaken the dollar,” Rabobank’s Foley said.

--With assistance from Anya Andrianova.

©2023 Bloomberg L.P.