Feb 1, 2024

El Salvador Bonds Soar After Nayib Bukele Tells Investors He’s Working With the IMF

, Bloomberg News

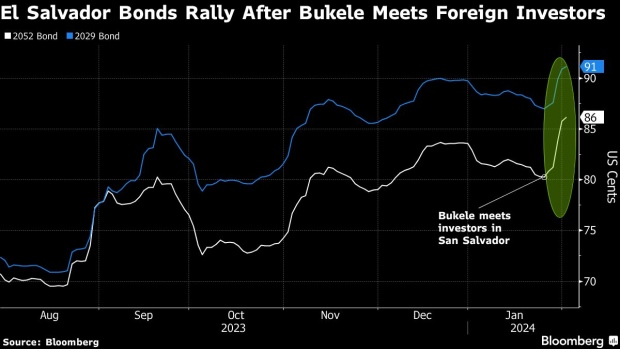

(Bloomberg) -- El Salvador bonds have rallied among the most in emerging markets in the past week after Nayib Bukele told investors the country is working to reach an agreement with the International Monetary Fund.

Notes jumped after Bukele, the frontrunner in Sunday’s presidential election, met investors in San Salvador and vowed to continue paying bondholders while he holds talks with the Fund. The sovereign debt has returned more than 5% since the Jan. 25 meeting, with bonds due 2052 soaring 5.7 cents to 86 cents on the dollar.

Bukele, who first won office in 2019, told foreign money managers a deal with the IMF would significantly strengthen the country’s financial position, according to a statement from the Finance Ministry. The statement did not say how much the government is seeking or under what terms.

Bukele, 42, has won over the market in the last 18 months by buying back bonds, carrying out a pension debt exchange and working to refinance local short-term obligations. Notes due in 2029 have risen more than 60 cents on the dollar over the time period, according to data compiled by Bloomberg.

The debt rework has earned El Salvador credit rating upgrades by S&P Global Ratings and Fitch Ratings, though the nation remains deep in junk territory.

--With assistance from Zijia Song.

©2024 Bloomberg L.P.